Nifty Open Interest Put Call ratio fell to 0.76 levels from 1.02 levels - HDFC Securities Ltd

NIFTY : Mildly weak, but the trend remains up.

NIFTY METAL INDEX: Downtrend Continues With Bearish Dow Formation.

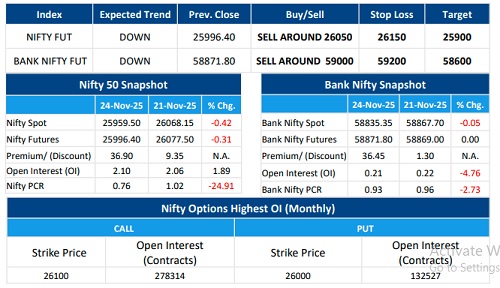

F&O Highlights

SHORT BUILD UP WAS SEEN IN THE NIFTY FUTURES

Create shorts with the SL of 26150 levels.

* After opening with a 50-point gap up on strong global cues, profit-booking emerged at higher levels as the session progressed. Nifty 50 reversed sharply, slipping 230 points from the intraday peak of 26,142 to close near the day’s low. Nifty finally ended the day with losses of 108 points at 25,959.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 1.89% with Nifty falling by 0.42%.

* Long Unwinding was seen in the Bank Nifty Futures where Open Interest fell by 4.76% with Bank Nifty falling by 0.05%.

* Nifty Open Interest Put Call ratio fell to 0.76 levels from 1.02 levels.

* One day before the expiry, We have seen lower rollover of 55.79% in the Nifty to the Dec series as against last three series average rollover of 63.65%. Lower rollover is seen in the Bank Nifty futures also where we have seen rollover of 52.36% as against last thee series average rollover of 60.74%.

* Amongst the Nifty options (25-Nov Expiry), Call writing is seen at 26100-26200 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26100-26200 levels. On the lower side, an immediate support is placed in the vicinity of 25800-25900 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 1,566 cr with their Open Interest going up by 6640 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Market Quote : The global market is experiencing a heightened uncertainty due to US tariff i...