Dhaniya Report 05th Feb 2025 by Amit Gupta, Kedia Advisory

Strong Fundamentals and Bullish Technicals a Prominent 2026 Performer

Key Highlights

* January rally of 12% driven by delayed sowing, tight stocks, and improving demand.

* Area under cultivation and production likely lower than last year, tightening supply.

* Carryover stocks sharply reduced to 20–22 lakh bags, supporting medium-term prices.

* Charts confirm a strong rounding-bottom breakout on weekly and monthly timeframes.

* Short-term harvest pressure possible, but long-term bias remains firmly bullish.

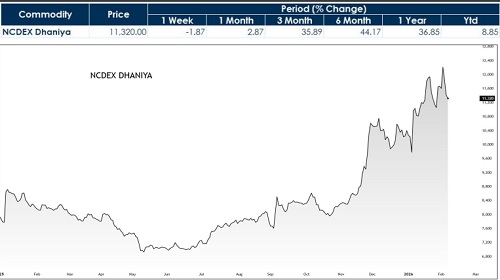

Dhaniya has emerged as one of the fundamentally strongest agri-commodities as we enter 2026, with January itself setting a decisive bullish tone. Prices began the month near Rs.10,500 and rallied sharply to a high of Rs.12,090, before closing around Rs.11,670—marking a solid gain of nearly 12% for the month. This move reflects a clear shift in market perception, driven by tightening supply dynamics and improving demand visibility.

On the supply front, delayed sowing across key producing regions has played a critical role in supporting prices. Weather-related concerns are also expected to impact yields, adding uncertainty to output estimates. More importantly, carryover stocks are significantly lower this season, estimated at just 20–22 lakh bags, compared with much higher inventories last year. Production in the previous season stood at around 1 crore 10 lakh bags, but current estimates suggest output may fall below 1 crore bags this year, given the decline in area under cultivation. This tightening supply scenario has already started reflecting in prices, with Dhaniya touching levels close to Rs.12,500 during February.

Demand-side factors further strengthen the outlook. The easing of US–India trade tensions is expected to support spice exports, while Middle East geopolitical concerns are gradually cooling, improving sentiment across global food markets. Ahead of Ramzan, Gulf demand has been steady to slightly positive, and export momentum is likely to pick up as the season progresses. Domestic demand is also set to remain strong, supported by the upcoming marriage season, sustained HoReCa consumption, and Indian festival-related buying. A weaker rupee near 90.40 continues to enhance India’s export competitiveness, making Dhaniya more attractive to international buyers.

Technical View

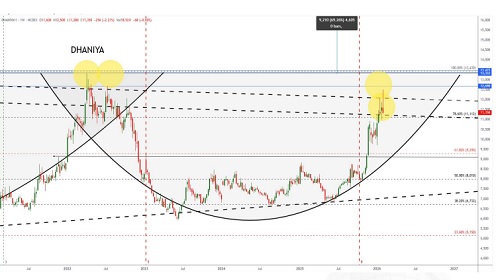

From a technical perspective, Dhaniya displays a very strong structure. Weekly charts confirm a clear rounding-bottom breakout, which earlier indicated a move towards the Rs.11,000 zone—now successfully achieved. On a broader timeframe, the market has carved out a neckline near Rs.12,500, highlighting a powerful bullish setup on both weekly and monthly charts. Momentum indicators remain constructive, reinforcing the medium- to long-term uptrend.

Outlook

In the near term, as harvest approaches, some corrective pressure cannot be ruled out, and prices may retrace towards Rs.10,500– Rs.10,700. However, this should be viewed as a healthy correction rather than a trend reversal. Fundamentally, Dhaniya remains one of the strongest agri-commodities going into 2026. With limited carryover stocks, lower production expectations, supportive export dynamics, and robust technical strength, Dhaniya is likely to attract prominent buying interest across the year, making it a standout performer within the spices complex.

Above views are of the author and not of the website kindly read disclaimer