Deposit Growth Continues to Outpace Credit Offtake; CD Ratio Remains Below 80% by CareEdge Ratings

Synopsis

* Credit offtake and deposit growth have cooled, with deposit growth continuing to outpace credit offtake in the current fortnight.

* As of June 13, 2025, credit offtake reached Rs 183.1 lakh crore, marking an increase of 9.6% year-onyear (y-o-y), significantly slower than last year’s rate of 15.5% (excluding merger impact). The slowdown can be attributed to a high base effect and muted growth across segments, including retail.

* Deposits rose 10.4% y-o-y, totalling Rs 230.7 lakh crore as of June 13, 2025, a decrease from 12.1% the previous year (excluding merger impact). This slower growth is primarily attributed to an unfavourable base effect, deposit repricing and a rise in alternative investment opportunities.

* The Short-Term Weighted Average Call Rate (WACR) decreased to 5.27% as of Jun 20, 2025, from 6.68% on Jun 21, 2024. This decline follows three successive repo rate cuts and liquidity infusion by the Reserve Bank of India (RBI).

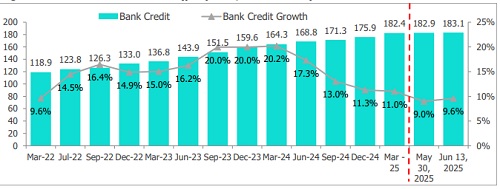

Bank Credit Growth Rate Cools for the Fortnight

Figure 1: Bank Credit Growth Trend (y-o-y% %, Rs Lakh crore)

* Credit offtake rose by 9.6% y-o-y and increased by 0.1% sequentially for the fortnight ending Jun 13, 2025, and came in slower than the previous year’s growth of 15.5% (excluding the merger impact). This slowdown can be attributed to weaker momentum, a higher base effect, and muted growth across segments, including retail, which has seen a slowdown in the unsecured personal loans, mortgages, and vehicle loan sub-segments.

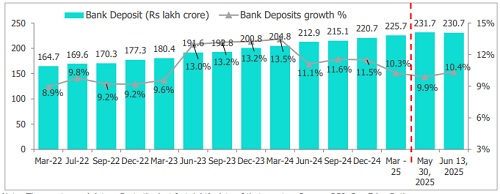

Figure 2: Bank Deposit Growth Rate Decreased Marginally for the Fortnight (y-o-y%

* Deposits increased by 10.4% y-o-y and fell by 0.44% sequentially, reaching Rs 230.7 lakh crore as of June 13, 2025, lower than the 12.1% growth (excluding merger impact) recorded last year. Banks are increasingly relying on certificates of deposit to meet their funding needs, amid subdued deposit growth, as competition has intensified in the bulk deposit segment.

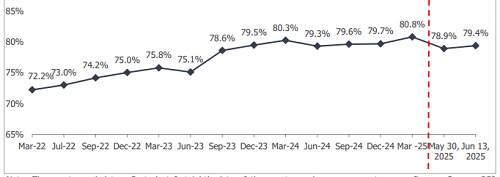

Figure 3: Credit-to-Deposit (CD) Ratio Slightly Declines, Remains Below 80% – Incl. Merger Impact

* The Credit-Deposit (CD) ratio witnessed a marginal rise yet continued to remain below the 80% mark for the six consecutive fortnights. As of Jun 13, 2025, the CD ratio was 79.4%, up by 47 basis points from the previous fortnight. This increase was primarily driven by deposit outflow compared to a growth in credit offtake of Rs 0.59 lakh crore during the current fortnight.

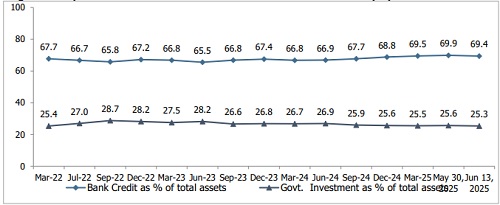

Share Bank Credit and Govt. Investments Witness Marginal Decline

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

* The credit-to-total-assets ratio witnessed a marginal downtick and decreased to 69.4%, while the Government Investment-to-total-assets ratio also reduced to 25.3%, for the fortnight ending June 13, 2025. Additionally, overall government investments totalled Rs 66.9 lakh crore as of June 13, 2025, reflecting a y-o-y growth of 7.4% and a sequential decline of 0.2%.

Above views are of the author and not of the website kindly read disclaimer