Daily Derivatives Report 20th Aug 2025 by Axis Securities Ltd

The Day That Was:

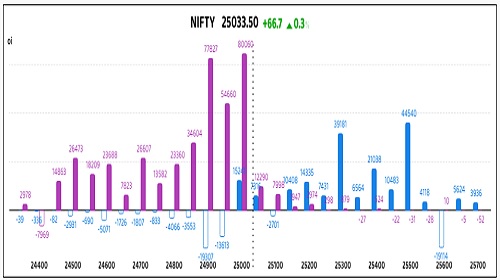

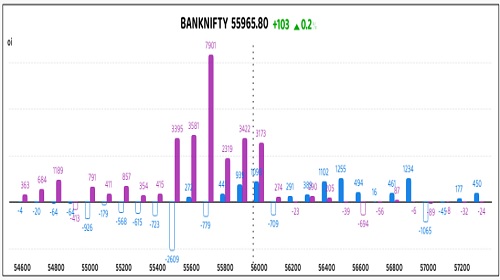

Nifty Futures: 25,033.5 (0.3%), Bank Nifty Futures: 55,965.8 (0.2%).

Nifty Futures rose by 66.7 points with open interest decreasing by 65,475 shares, a decline of 0.4%, indicating short covering. Bank Nifty Futures also saw short covering as it gained 103 points while its open interest decreased by 1,03,425 shares, or 3.5%. The Nifty futures premium narrowed to 53 points from 90, while the Bank Nifty premium decreased from 128 to 101 points. The domestic equity benchmarks closed with decent gains for a fourth consecutive session, driven by positive sentiment from ongoing Russia-Ukraine peace talks and optimism surrounding potential GST reforms, for sectors such as automobiles and consumer goods. Sector-wise, oil & gas, media, and auto stocks advanced, while pharma and financial services shares saw a decline. India VIX, a key measure of market volatility, fell 4.5% to close at 11.79. The rupee appreciated against the US dollar, closing at 86.99.

Global Movers:

US markets ended in the red yesterday, as big tech stocks were hit. The S&P 500 finished 0.6% down at 6411, while the Nasdaq 100 closed 1.4% lower. Each member of the Magnificent 7 basket closed down, as the index suffered its worst drop since August 1st. There have been mounting concerns lately about stretched valuations and how the rally may have gone too far, too fast, so investors are unlikely to make big bets until Fed Chair Powell's speech later this week clears the air on the future path of monetary policy. Coming to the markets, the VIX rose nearly 4% and finished at 15.5, the dollar index was slightly higher, and the US 10-year yield dropped back to 4.3%. In commodities, gold ended 0.5% lower at $3315/ounce on ongoing attempts to end the Russia-Ukraine war while brent oil continued to hover around $66 as inventories dropped.

Stock Futures:

Samvardhana Motherson, IIFL Finance, Bharat Dynamics, and Kalyan Jewellers witnessed sharp intraday movements, driven by a surge in trading volumes and pronounced price volatility. These counters remained actively in play as traders responded to fresh cues stemming from quarterly earnings announcements or company-specific developments.

Samvardhana Motherson International Ltd. (MOTHERSON) surged to its highest monthly close, propelled by resilient investor sentiment and management’s assurance that US tariffs on Indian imports would not materially impact operations. Despite a dip in consolidated PAT due to structural headwinds in Europe, the company posted a YoY rise in revenue from operations, reinforcing its fundamental strength. The stock registered a 5.5% gain amid Short Covering, with futures open interest shedding 192 contracts to settle at 26,325, signalling the unwinding of bearish positions. In options, call OI declined by 84 contracts to 7,296, while put OI rose sharply by 1,251 contracts to 6,362, lifting the PCR to 0.87 from 0.69. The shift in option positioning suggests a cautious bullish bias, with put writers gaining confidence as downside protection demand increases.

IIFL Finance Ltd. (IIFL) rallied 5.1%, reversing recent volatility and attracting fresh long positions following upbeat company commentary and improved analyst outlook. Futures open interest climbed 2.5% with 202 new contracts added, reaching 8,178, while the futures premium to spot widened by 0.1 points to 0.35, reflecting strengthening bullish sentiment. Option data revealed a contraction in both call and put OI, down 179 and 213 contracts, respectively, bringing total call OI to 3,399 and put OI to 1,953, with PCR slipping to 0.57 from 0.61. The decline in option volumes alongside rising futures interest indicates directional conviction among long holders, while reduced put activity points to waning downside hedging.

Bharat Dynamics Ltd. (BDL) tumbled 3.6%, weighed down by Q1FY26 results and easing geopolitical tensions that dampened sentiment across defence stocks. The stock saw a Short Addition with futures open interest surging 7.4% through 1,027 new contracts, totalling 14,885, underscoring bearish build-up. In options, call OI jumped by 1,253 contracts to 9,221, while put OI contracted by 95 contracts to 6,406, dragging the PCR down to 0.69 from 0.82. The aggressive call writing paired with reduced put interest reflects a shift toward bearish positioning, with option writers anticipating limited upside amid valuation concerns.

Kalyan Jewellers India Ltd. (KALYANKJIL) declined 2.5% despite robust Q1FY26 earnings, including a 48.7% rise in PAT and 31.5% revenue growth, as profit booking and valuation fatigue weighed on sentiment. The stock witnessed a Short Addition with futures open interest climbing 9.7% via 2,383 new contracts, reaching 27,030, while the futures premium to spot edged up 0.05 points to 1.7. Option data showed aggressive call writing with 4,865 contracts added, lifting total call OI to 24,711, while put OI rose modestly by 900 contracts to 8,203, pushing PCR lower to 0.33 from 0.37. The skewed call build-up signals heightened bearish sentiment, with option writers positioning for further downside despite strong fundamentals.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.14 from 1. points, while the Bank Nifty PCR rose from 0.77 to 0.82 points.

Implied Volatility:

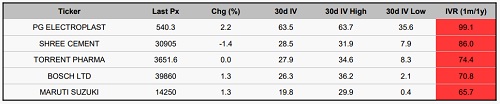

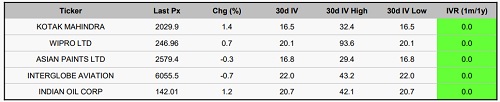

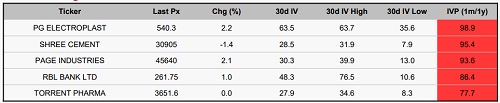

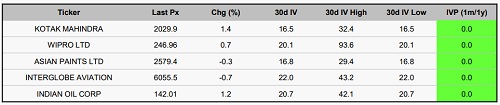

PGEL and Shree Cement are facing high market volatility, with their implied volatility (IV) rankings at 99% and 86%, respectively. PGEL has an IV of 64%, and Shree Cement's IV is at 29%. These high IV levels mean that options on these stocks are more expensive due to higher risk and greater market uncertainty, leading to bigger price swings. Traders need to be cautious, as these stocks are riskier and harder to predict. On the other hand, Kotak Bank and Wipro have much lower IVs of 17% and 20%, indicating more stable price movements. This makes their options cheaper and less prone to sharp changes, making them more attractive for straightforward strategies like buying calls or puts, and especially for options sellers looking for lower risk.

Options volume and Open Interest highlights:

Mazagon Dock and Tube Investments are currently experiencing strong bullish sentiment, as indicated by their high call-to-put volume ratios of 6:1 and 5:1, respectively. This suggests a strong expectation of price gains. However, the high options volume also signals elevated premiums, which may caution traders about the higher costs of entering new long positions. In contrast, BDL and Apollo Hospitals are under significant selling pressure, as reflected in their high put-to-call ratios. This surge in put options implies that these stocks may be nearing oversold levels, presenting potential opportunities for contrarian traders. However, the dominant bearish sentiment in the options market points to a generally negative outlook. Max Health and Nuvama Wealth show a balanced call-and-put distribution, signaling expectations of increased price volatility. Meanwhile, Amber Ltd displays a bullish bias, with rising call activity suggesting optimism for future price movements. Although Heromotoco and Maruti Suzuki have recently been bullish, the uptick in put volume hints at potential volatility and a more cautious market sentiment moving forward. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a net increase of 1,848 contracts was observed, driven exclusively by client additions of 1,848 contracts. This bullish stance from retail investors stands in stark contrast to the bearish bias of institutional players, as Foreign Institutional Investors (FIIs) and proprietary traders significantly decreased their positions by 207 and 1,495 contracts, respectively. Conversely, in the stock futures market, a total change of 35,002 contracts reflects a more complex dynamic. The dominant driver was the substantial addition of 34,894 contracts by FIIs, indicating a strong institutional conviction in specific stocks. This contrasts sharply with the minimal long positions added by clients (108 contracts) and the notable unwinding of 21,161 contracts by proprietary desks. This divergence highlights a potential institutional-led positive trend in individual stocks, while other key participants exhibit a more cautious or even negative outlook.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633