Daily Derivatives Report 18th November 2025 by Axis Securities Ltd

The Day That Was:

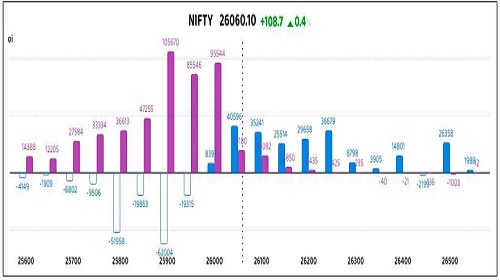

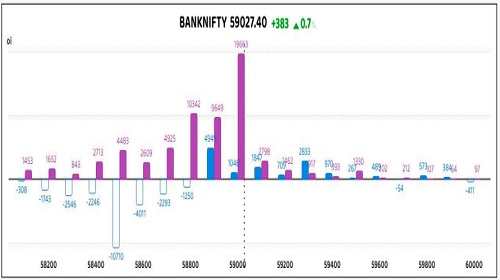

Nifty Futures: 26,060.1 (0.4%), Bank Nifty Futures: 59,027.4 (0.7%).

Nifty Futures and Bank Nifty Futures extended their winning streak, driven by market optimism over policy continuity following the NDA's (BJP-led alliance) Bihar election victory and fresh Reserve Bank of India (RBI) support measures for exporters affected by recent tariff disruptions. This positive sentiment, which largely defied mixed global cues and was further buoyed by potential progress on an India-U.S. trade deal and stock-specific post-earnings action, resulted in moderate gains. Specifically, Nifty Futures rose 108.7 points with a reduction in open interest, a decrease of 80,280 shares (a 0.4% reduction) to 203.93 lakh shares, indicating Short Covering. Concurrently, Bank Nifty Futures rose 383 points with an increase in open interest of 92,190 shares (a 4.8% increase) to 20.19 lakh shares, signalling Long Build Up. The Nifty futures premium increased to 47 points from 41, while the Bank Nifty premium decreased from 127 to 65 points. All sectoral indices closed in the green, with Public Sector Undertaking (PSU) Bank, Auto, and consumer durables shares registering the most significant gains. Reflecting a decrease in near-term volatility expectations, the India VIX declined 1.29% to 11.78. Meanwhile, the Rupee rose 3 paise to close at 88.63 against the U.S. dollar, opening at 88.70, hitting an intra-day high of 88.56, and a low of 88.73, supported by the firm domestic equity markets and lower global crude oil prices.

Global Movers:

U.S. equity markets opened the week on a sharply negative note, as investor sentiment was heavily weighed down by a continued retreat in high-momentum technology stocks, particularly those linked to Artificial Intelligence (AI). This broad-based decline, ahead of key earnings reports and the release of delayed economic data following the government shutdown, reflected deepening concerns over sector valuations and the persistent caution surrounding future Federal Reserve policy. The Dow Jones Industrial Average suffered a significant loss, dropping 1.2% to close at 46,590.24. The benchmark S&P 500 declined by 0.9%, settling at 6,672.41, further pulling back from its recent all-time high. The Nasdaq Composite experienced a substantial drop of 0.8%, ending the session at 22,708.07, marking its second consecutive weekly decline. The yield ticked lower, falling by 0.015 percentage point to settle at 4.13%. Oil prices edged lower amid global demand concerns, with the nearby Brent Crude Futures contract closing at approximately $64.33 per barrel, precious metals sold off on a stronger US Dollar and fading Fed rate-cut hopes. Spot Gold fell significantly, trading near $4,019.12 per ounce and following gold's lead, Spot Silver also saw a slight decline, closing near $50.10 per ounce.

Stock Futures:

Housing and Urban Development Corporation Ltd. (HUDCO) traded with a mildly positive bias as Q2 FY26 results underscored resilience, with Net Profit rising 3.1% YoY and Revenue from operations surging 27.9% YoY. Investor sentiment strengthened further on the company’s plan to mobilize a $1 Bn infrastructure fund backed by Germany’s KfW and ADB. Derivatives action reflected Short Covering, with the stock advancing 5.3% alongside a 9.1% drop in futures open interest to 12,300 contracts, shedding 1,226 positions. Options data showed call open interest at 9,538 contracts, down 2,284, while puts rose by 420 to 5,476, lifting the PCR to 0.57 from 0.43. The positioning indicates option buyers are tilting towards downside protection, while option writers are reducing bullish exposure, signaling cautious optimism tempered by defensive hedging.

Siemens Ltd. (SIEMENS) surged with strong bullish momentum as Q4 FY25 performance highlighted a 16% YoY rise in Revenue from Operations and a 10.5% increase in New Orders, offsetting a 7% decline in PAT attributed to the absence of a one-off property gain in Q4 FY24. Futures activity confirmed Long Addition, with a 4.8% price gain and open interest climbing 5.8% to 23,302 contracts, the highest in three series, with 1,270 new positions added. Options positioning revealed call open interest at 11,664 contracts, up 742, while puts expanded sharply by 3,326 to 9,137, pushing PCR higher to 0.78 from 0.53. The derivatives setup suggests option buyers are aggressively building both sides, while sellers are balancing risk, reflecting conviction in sustained upward momentum but with hedges against volatility.

Tata Motors Passenger Vehicles Ltd. (TMPV) slumped under heavy bearish sentiment as Q2 FY26 consolidated results disappointed, dragged by Jaguar Land Rover’s cyber incident-led production loss of 20,000 units, tariff costs, and adverse forex, driving EBIT margin to a multi-year low of 8.6% and forcing guidance cuts to 0-2% from 5-7%. Futures data showed Short Addition, with the stock falling 5.2% and open interest soaring 31.3% to 1,02,275 contracts, with 24,370 new positions added. Options positioning was skewed, with calls rising sharply by 38,501 to 91,714 contracts, while puts added 8,300 to 37,593, dragging PCR down to 0.41 from 0.55. The derivatives landscape highlights option buyers crowding into calls despite price weakness, while option writers are aggressively selling puts, reflecting a market bracing for continued downside pressure with limited recovery bets.

Mphasis Ltd. weakened under bearish sentiment as sector-wide caution weighed, despite Q2 FY26 Net Profit rising 10.8% YoY. Concerns over margin compression, with Gross Margins slipping 80 bps QoQ and YoY to 28.1%, alongside uncertainty around US H-1B visa costs, pressured the stock. Futures action showed Long Unwinding, with a 3.3% price decline and open interest marginally lower at 16,671 contracts after shedding 9 positions, while the premium to spot narrowed to 19.8 points from 27.8. Options positioning reflected call open interest climbing 3,487 to 10,314 contracts, while puts added 2,309 to 5,682, signaling balanced build-up. The PCR stood at 0.55, indicating option buyers are cautiously hedging downside risk, while option writers are maintaining exposure with limited conviction, underscoring fragile sentiment across IT counters.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.13 from 0.92 points, while the Bank Nifty PCR rose from 0.97 to 1.18 points.

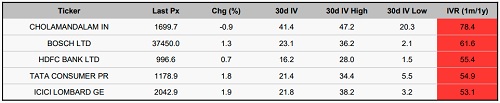

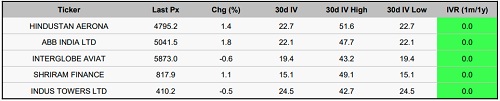

Implied Volatility:

Cholamandalam Investment (78% IVR) & HDFC Bank (55% IVR) Both stocks are at the upper extreme of their historical volatility spectrum, leading to significant overpricing of options (high premiums/costs). Due to unfavourable economics for long positions, the optimal approach would be short premium strategies which aims at monetizing the high time value and anticipate a mean-reversion of volatility. Hindustan Aeronautics (23% IVR) & ABB (22% IVR) Both stocks are trading with suppressed volatility, resulting in cheaper option contracts. This low-IV environment favours long premium strategies. It offers an asymmetric play where low capital is deployed to capture large potential returns from either future price movement or volatility expansion and better risk/breakeven metrics.

Options volume and Open Interest highlights:

Dmart and VBL are exhibiting noticeable directional bullishness, underscored by extreme Call-to-Put Volume Ratios of 5:1 each, though the surge in speculative call activity has inflated Implied Volatility, rendering long-side option entry costly and historically signaling potential exhaustion of the prevailing uptrend. Asian Paint and Muthootfin, in contrast, reflect a defensive stance with heavy Put volumes and concentrated Put OI at lower strikes, creating gravitational pressure toward support zones; yet, any price consolidation could swiftly unwind these hedges, sparking a sharp short-covering rally. Bandhan Bank and Delhivery show symmetrical expansion in both Call and Put OI near 52-week highs, a hallmark of indecision that warrants caution until a clear breakout or breakdown emerges. Dabur’s near-annual high Call OI points to strategic Call writing, establishing a formidable supply ceiling and raising the likelihood of resistance at elevated levels. Amber Ltd’s persistent Put OI build around yearly peaks highlights a defensive bias, reflecting market apprehension over potential drawdowns and reinforcing capital-preservation strategies among option writers, while option buyers remain positioned for downside risk. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the aggregate net increase of 446 contracts stemmed predominantly from an aggressive accumulation of 334 contracts by Foreign Institutional Investors (FIIs), complemented by a substantial rise of 112 contracts from Proprietary traders; conversely, Clients demonstrated a modest yet notable reduction of 121 contracts, suggesting divergent directional conviction regarding the benchmark indices. Conversely, the stock futures segment witnessed a dramatic net turnover of 25,695 contracts, characterized by an overwhelmingly bullish accumulation of all 25,695 contracts by Clients, which was counterbalanced by the sharpest distributive contraction of 19,074 contracts from FIIs and a significant de-risking via a reduction of 4,838 contracts by Proprietary traders; this pronounced asymmetry underscores a speculative optimism by retail participants against a backdrop of institutional profit-taking or risk-off positioning in individual stocks.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

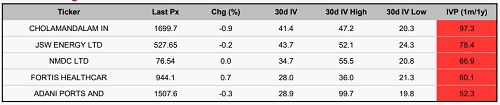

Stocks With High IVP:

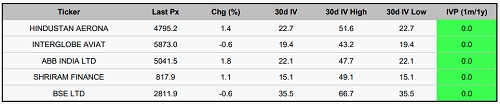

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

FIIs were net sellers in Cash to the tune of 10,016.10 Cr and were net sellers in index futu...