Daily Derivatives Report 15th October 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,206.0 (-0.4%), Bank Nifty Futures: 56,716.4 (-0.2%).

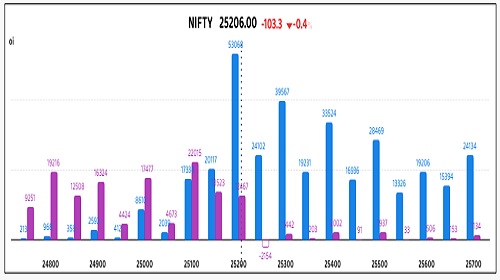

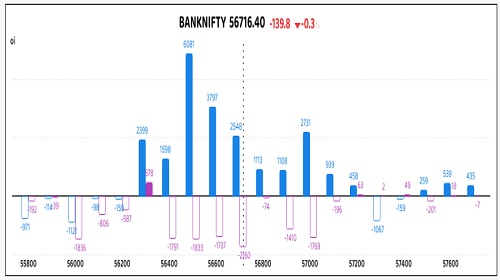

Nifty futures and Bank Nifty futures registered their second consecutive session of losses, primarily due to profit booking amidst mixed global cues and the subdued commencement of the domestic Q2FY26 earnings season. The Nifty Futures contract experienced a decline of 103.3 points. Concurrently, its Open Interest (OI) saw a significant rise of 3.7%, reaching 196 Lc (1,95,94,950) with an addition of 6,95,700 shares to OI, signalling a Short Build Up. Conversely, the Bank Nifty Futures dropped by 139.8 points, coupled with a decrease in its OI by 4.5% to 19 Lc (19,00,745), reflecting Long Unwinding. The premium on Nifty futures contracted to 61 points from 82 points, and the Bank Nifty premium narrowed from 231 to 220 points. The negative sentiment was fuelled by renewed concerns over US-China trade tensions and weaker-than-expected domestic inflation data, which intensified slow demand worries and prompted broad-based profit booking. This sell-off was particularly pronounced in the midcap and small cap segments, which consequently underperformed the Nifty. Weak macroeconomic indicators, including the poorer-than-expected inflation print, coupled with a muted start to the Q2 corporate earnings season, raised further concerns regarding a slowdown in domestic consumption. All sectoral indices concluded the session in negative territory, with PSU banks, media, and metal stocks absorbing the steepest losses. The India VIX, a gauge of the market's expectation of near-term volatility, climbed by 1.33% to 11.16. The Rupee (INR) depreciated marginally against the US Dollar (USD-INR), closing around 88.80 and maintaining proximity to its record low, driven by a waning risk appetite.

Global Movers:

US stocks finished down yesterday, as investors assessed the chances of an escalation in the US-China trade war. The S&P 500 ended 0.2% down after rebounding from losses of as much as 1.5%, while the Nasdaq 100 fell 0.7%. Dip buyers of US equities remain active as they deploy the TACO trade, but it remains to be seen if that's a good idea should the spat intensify. Earnings season has begun in the US with six of the largest banks declaring numbers, and these have been largely positive. In related markets, the VIX jumped over 9%, while the dollar index and the 10-year yield fell. Spot gold ended 0.8% in the green and at yet another record in a day that saw wild swings, thanks to all the headlines around the evolving situation with China. Elsewhere, brent prices dropped 1.5% to finish just above $62/barrel.

Stock Futures:

Multi Commodity Exchange of India Ltd. (MCX) surged to a fresh 52-week and all-time high, propelled by a sharp uptick in bullion options volumes that have significantly diversified its revenue mix, mitigating reliance on energy contracts. The exchange recorded a Long Addition with a 4.9% price gain and a 9.4% rise in open interest, adding 1,969 contracts to a total of 23,003 in futures. Option activity reflected heightened bullish sentiment, with call open interest at 21,771 contracts and put open interest at 21,023, driven by additions of 4,199 and 6,621 contracts, respectively. The Put-Call Ratio climbed to 0.97 from 0.82, indicating a balanced yet strengthening bullish bias, as put writers appear more aggressive amid rising participation.

Indian Renewable Energy Development Agency Ltd. (IREDA) rallied following robust Q2FY26 earnings, showcasing a 41.5% YoY jump in consolidated net profit to Rs 549 Cr and a 26.2% rise in operational revenue, underpinned by strong loan book expansion and an 86% surge in loan sanctions. The stock saw a Long Addition with a 3% price gain and an 11.8% increase in open interest, adding 1,481 contracts to reach 14,064 in futures. Despite futures trading at a discount of 0.78 points to spot, widening from 0.32, option data revealed bullish undertones with call open interest at 13,634 contracts and put open interest at 5,675, supported by additions of 3,978 and 1,495 contracts, respectively. The skewed call positioning suggests option buyers are pricing in continued upside momentum.

UNO Minda Ltd. faced a sharp reversal, shedding 3.9% on heavy volumes after a downgrade by a domestic brokerage citing expected moderation in PV segment growth. The stock registered Long Unwinding with a 6% drop in open interest, shedding 449 contracts to settle at 7,076 in futures. Despite the correction, futures traded at a premium of 4.5 points to spot, up from 3.1, reflecting residual bullish undertones. In options, call open interest stood at 7,036 contracts versus 3,166 in puts, with additions of 652 and 221 contracts, respectively. The disproportionate build-up in calls amid declining price signals options writers positioning for further downside or volatility.

Bandhan Bank Ltd. declined 3.5% amid rising concerns over asset quality and provisioning ahead of its Q2FY26 results, triggering a Short Addition with a 6.6% rise in open interest and 1,797 new contracts, bringing futures OI to 28,890. The futures premium narrowed to 1.46 points from 1.59, reflecting weakening sentiment. Option data showed call open interest at 11,405 contracts and put open interest at 8,661, with respective additions of 2,073 and 1,040 contracts. The higher call accumulation relative to puts, despite price weakness, suggests option sellers are bracing for continued pressure with limited upside expectations.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.91 from 1.07 points, while the Bank Nifty PCR fell from 1.13 to 1. points.

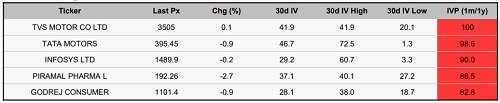

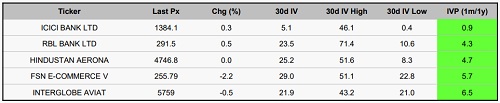

Implied Volatility:

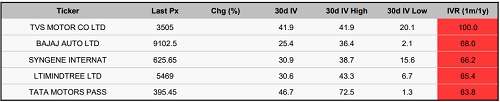

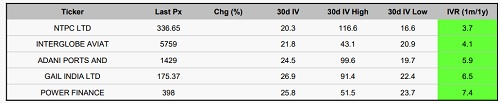

Bajaj Auto (BAJAJ-AUTO) and TVS Motors are currently experiencing elevated volatility in the derivatives segment, as reflected in their high Implied Volatility (IV) Ranks of 68% and 100%, respectively. These elevated IV percentiles correspond with robust Expected Volatility (EV) readings 42% for Bajaj Auto and 25% for TVS Motors indicating strong market expectations of price dispersion in the near term. The spike in volatility has led to a meaningful expansion in option premiums, thereby increasing the margin and capital requirements for deploying both hedging and speculative strategies. As a result, options on these counters have become capital-intensive, reducing their attractiveness for low-cost directional setups. In contrast, Interglobe Aviation and NTPC are operating within a low-volatility regime relative to the broader F&O universe. Their muted Expected IVs of 22% and 20%, respectively, have contributed to significant premium compression. This environment presents a more favourable cost structure for directional strategies. Specifically, Long Call or Long Put positions on these underlying benefit from lower upfront premium outlays, thereby improving the risk-reward dynamics for speculative exposure.

Options volume and Open Interest highlights:

Page Industries and 360ONE are demonstrating pronounced bullish sentiment, as evidenced by their elevated Call-to-Put Volume Ratios of 7:1 and 6:1, respectively. These ratios reflect aggressive long exposure and a strong directional bias toward upside potential in the underlying equities. The surge in Call option demand has led to a notable expansion in implied premiums, thereby increasing the cost of initiating fresh long positions. Such extreme skew in favour of Calls may also signal potential exhaustion in the rally, warranting a contrarian lens as it could indicate overbought conditions. Dixon Technologies (India) and REC Ltd are witnessing a rise in Put option activity, with Put-to-Call Volume Ratios at a balanced 1:1. This uptick in Put volumes suggests a cautious undertone among market participants, indicative of heightened risk aversion and increased demand for downside protection. A substantial build-up in Put Open Interest (Put OI) typically aligns with bearish sentiment or hedging strategies. However, concentrated Put positioning may also imply that these counters are approaching oversold levels, potentially offering contrarian entry points for value-seeking investors. Crompton Ltd and Kaynes Technology (KAYNES) exhibit a neutral-to-bearish undertone, with concurrent increases in Open Interest across both Call and Put contracts. This pattern points to expectations of elevated near-term volatility, with traders positioning for potential price swings in either direction, albeit with a slight negative bias. RVNL has recorded a rise in Call-side activity, generally interpreted as a bullish signal and indicative of positive price expectations. Nonetheless, this trend merits a nuanced assessment, as the increase could stem from Call writing strategies such as short-covering or hedging rather than outright speculative buying. Suzlon Ltd continues to show consistent accumulation in Put Open Interest, reinforcing a defensive posture among market participants. While directional conviction remains muted, the persistent build-up in protective Puts underscores prevailing concerns around short-term volatility and downside risk. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

in index futures open interest reveals divergent tactical positioning, indicating a nuanced market sentiment. FIIs (Foreign Institutional Investors) exhibited a pronouncedly bearish stance, aggressively liquidating 8,671 contracts, a move sharply countered by the robustly bullish aggression of Proprietary traders, who accumulated a substantial 10,755 contracts, while Retail clients maintained a moderately bullish posture, adding 1,247 contracts. Furthermore, in the stock futures segment, where 64,914 contracts saw positional shifts, the market bias appears acutely polarized as FIIs executed a massive, entirely bearish reduction of 64,914 contracts a staggering deleveraging move that was partially offset by significant bullish conviction from Proprietary traders adding 26,179 contracts and, complementarily, by 18,419 contracts added by Retail clients, underscoring a fundamental disagreement on immediate directional market trends.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

The Nifty 50 closed the day at 24542 after facing selling pressure near 24850 - Religare Bro...