Daily Derivatives Report 12th December 2025 by Axis Securities Ltd

The Day That Was:

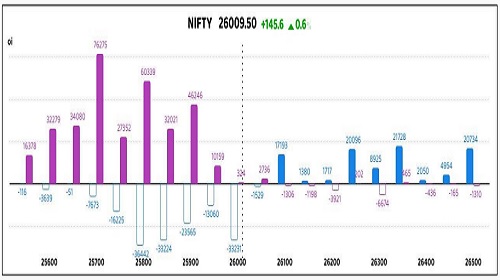

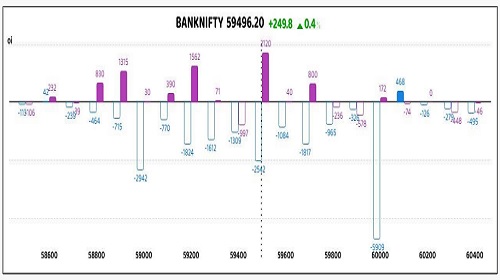

Nifty Futures: 26,009.5 (0.6%), Bank Nifty Futures: 59,496.2 (0.4%).

Nifty Futures and Bank Nifty Futures ended their three-day losing streak with decent gains, staging a notable recovery following the US Federal Reserve's 25-basis-point interest rate cut, which lowered the target range to 3.50%–3.75% and boosted global liquidity and risk appetite. The key indices were lifted back into positive territory, signaling renewed buyer confidence and offsetting prior selling pressure. Nifty Futures advanced 145.6 points with a decrease in open interest, which fell by 4,70,860 shares to 181.37 lakhs (a 2.5% decrease), indicating significant short covering. Similarly, Bank Nifty Futures climbed 249.8 points as its open interest decreased by 1,04,195 shares to 19.93 lakhs (a 5% decrease), also driven by short covering. Reflecting this bullish sentiment in the derivatives market, the Nifty futures premium increased to 111 points from 106 points, though the Bank Nifty premium remained stable at 286 points. Rate-sensitive sectors and cyclical stocks led the market charge, with Auto, Metal, and Pharma shares advancing, while Media and Oil & Gas shares experienced declines. Simultaneously, India VIX, a gauge of near-term market volatility expectations, slipped 4.7% to 10.40, indicating a sharp decrease in expected market turbulence following the indices' strong bounce-back. Adding to the supportive market backdrop were reports of a renewed hope for progress on the India-US trade deal, though no official update was available. However, the gains were tempered by the Rupee, which opened at 89.95 in the interbank market but lost ground throughout the day, falling by 40 paise to close at a record low of 90.37 versus the dollar, after touching a record intra-day low of 90.48.

Global Movers:

US markets charted a mixed course on Thursday, as investors processed the Federal Reserve's latest policy action an expected 25 basis point (bps) rate cut, moving the federal funds rate to 3.5%–3.75%. This easing signal prompted a surge in blue-chip equities, with the Dow Jones Industrial Average leaping by 646 points or 1.34% to close at a record high of 48,704, and the S&P 500 Index also hitting a new peak by gaining 14 points or 0.21% to finish at 6,901.00. However, the tech-focused Nasdaq Composite pulled back slightly, highlighting caution in the sector. In fixed income, the rally in bonds continued, pushing the yield on the benchmark 10-year U.S. Treasury note down to 4.14%. Meanwhile, the expectation of a lower-rate environment bolstered commodities, with Gold futures (February 2026 contract) closing around $4,224.70 per ounce and Silver futures (March 2026 contract) continuing their blistering rally, while WTI Crude Oil futures fell to $57.60 per barrel amid concerns over global supply.

Stock Futures:

Dixon Technologies (India) staged a sharp technical recovery, surging 5.2% after touching a 52-week nadir, signaling opportunistic buying and a short-covering squeeze that unwound positions. This upward thrust was underpinned by a 2.8% decline in open interest (OI), shedding 1,276 contracts from a future OI of 44,659. The options landscape shifted notably, with the Put-Call Ratio (PCR) climbing to 0.50 from 0.43. Call options hold a dominant OI of 72,172 contracts against 36,172 in puts. While call OI saw a marginal addition of 96 contracts, put option OI witnessed a substantial surge of 5,395 additions, suggesting put buyers aggressively hedged against further decline, even as call writers-sellers maintained a cautious distance near the recent low.

Angel One Ltd (ANGELONE) demonstrated a powerful 5.1% rebound, fueled by recovering market sentiment following a period of sustained pressure tied to its disappointing November 2025 business update. This bounce was characterized by a potent short-covering rally, which saw futures OI contract by 3% or 488 contracts, leaving the total at 15,749. The discount of the futures price to the cash price narrowed significantly by 25.4 points, closing at 34.9 points, indicating a decrease in selling urgency. Options traders reduced both sides, with call OI falling by 2,132 contracts from 17,942, while put OI decreased by 541 contracts from 8,616, reflecting call writers-sellers liquidating positions, potentially expecting a continuation of the upward momentum, while put buyers also pared down their downside protection.

KFin Technologies Ltd (KFINTECH) registered a 5.1% gain, executing a decisive technical bounce after a sustained decline exceeding 9%, which had been driven by bearish sentiment and general sector caution. The market action was primarily a short-covering event, as evidenced by an aggressive 10.8% reduction in futures OI, with 882 contracts unwound, leaving the OI at 7,253, as short-term buyers capitalized on the stock's oversold valuation. In the options segment, call OI saw a reduction of 346 contracts from a total of 5,860, suggesting call writers-sellers booked profits or liquidated, while put OI increased by 200 contracts to 4,363, indicating put buyers added protection, signaling divergent views on the sustainability of the rally.

AU Small Finance Bank Ltd (AUBANK) cooled off, registering a 1.6% price decrease on profit-booking after its recent surge to a 52-week high, which was triggered by the Ministry of Finance approving an increase in the Foreign Investment Limit to 74%. This price consolidation was characterized by long unwinding, with a 3.5% decrease in futures OI, unwinding 702 contracts from a total OI of 19,122. Futures continued to command a premium over the spot price, which expanded by 5 points to 8.9 points, suggesting continued bullish conviction despite the profit-taking. In the options chain, call OI rose by 227 contracts to 8,275, while put OI declined by 274 contracts to 7,171, demonstrating increasing confidence among call buyers/writers-sellers and decreasing demand for downside hedges from put buyers/writers-sellers.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 0.94 from 0.73 points, while the Bank Nifty PCR rose from 0.82 to 0.87 points.

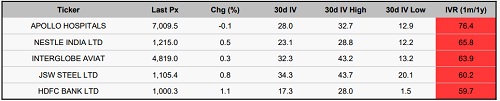

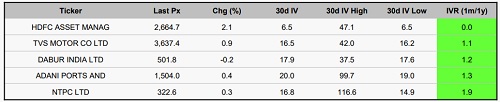

Implied Volatility:

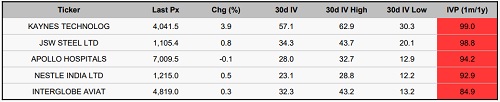

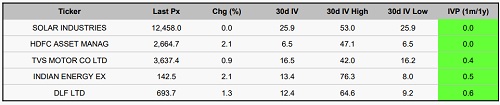

Apollo Hospital and Nestle Ltd are experiencing a significant surge in their options premiums, reflected by their high Implied Volatility Rankings (IVRs) of 76% and 66%, respectively. This elevated options pricing stands in sharp relief against their recent price movements, as indicated by their realized implied volatilities of 28% (Apollo) and 23% (Nestle). The high (IVR) and the stock's recent volatility suggests that options participants are bracing for, and actively pricing in, much larger future price swings than have been observed recently. Conversely, HDFC AMC and TVS Motors occupy the lowest tier of the F&O volatility landscape, both recording the lowest IVR. This low IVR translates into options contracts for these companies being perceived as undervalued or trading at a discount relative to their typical, historical volatility patterns. Their current realized implied volatilities are also modest, standing at 10% and 17%, respectively. The prevailing low-volatility sentiment signals that the market does not foresee any significant or dramatic future price movements for these two stocks.

Options volume and Open Interest highlights:

RVNL and TMPV are exhibiting extreme Call-to-Put Volume Ratios of 5:1, signalling a massive influx of Call option buying. This intense, one-sided volume suggests that options traders believe the recent upward price momentum is nearing exhaustion. The peak in Call buying often precedes a phase of profit-taking, potentially leading to a short-term price correction. A more negative or bearish sentiment is currently dominant in OFSS and Supreme Industries Ltd. This pressure is indicated by a noticeable surge in Put option trading volumes and a substantial buildup of Open Interest at lower price strikes, which typically function as a support or "price floor." However, because the overall volume ratios for these stocks remain balanced or neutral, there is a possibility that the bearish trend might face a minor reversal or be less severe than the options flow currently suggests. A period of extreme price volatility is anticipated for Kaynes Technology and InterGlobe Aviation Ltd, affecting both the bullish (Call) and bearish (Put) sides of their options chains. This high-volatility outlook also applies to BEL (with focus on the Call side) and TMPV (specifically on the Put side). The critical common factor for these stocks is the significant, dual-sided accumulation of both Call and Put Open Interest concentrated near their annual price highs. These heavy options positioning strongly implies that a rapid, sharp, and potentially violent directional price move is imminent, likely triggered when these large options contracts are closed out or "liquidated." (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures registered a 3,266 contract net addition, driven primarily by retail clients adding 1,607 and FIIs adding 1,355, indicating a clear bullish bias among these segments. Conversely, Proprietary traders aggressively sold 3,266 contracts, acting as the principal short counterparty to the buying by clients and FIIs, with DIIs adding a minor 304.In Stock Futures, the 43,042 contract net increase was entirely due to a massive 43,042 contract addition by FIIs, signalling an overwhelmingly long-biased approach in specific stocks. This was offset by broad-based liquidation/shorting from other participants: retail clients cut 7,842, DIIs reduced 18,715, and proprietary traders shed 16,485 contracts, reflecting caution or profit-taking.

Securities in Ban for Trade Date 12-December-2025:

1. BANDHANBNK

2. SAMMAANCAP

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633