Daily Derivative Report - 20th January 2026 by Religare Broking Ltd

Market Outlook

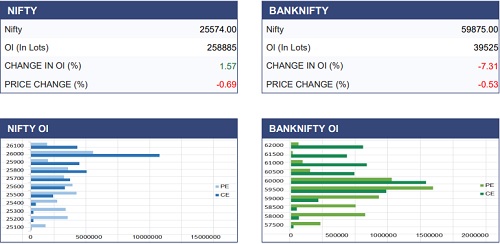

The Nifty 50 continued to trade with a bearish bias after a gap-down opening. However, a reversal was seen in the second half near the 25,500 level, which lifted the index towards 25,600 before settling the day at 25,585. On the daily chart, the index closed below the 100-DEMA, indicating the possibility of further downside if the 25,500 level is breached. In the derivatives segment, fresh call OI buildup was observed at the 25,600 strike, while the significant call OI already positioned at the 25,800 and 26,000 levels, highlighting strong overhead resistance. On the downside, fresh put OI buildup at the 25,500 strike indicates immediate support.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

More News

India VIX increased by 3.85% to close at 11.73 touching an intraday high of 12.05 - Nirmal B...