Daily commodity Outlook 4th December 2025 Axis Securities Ltd

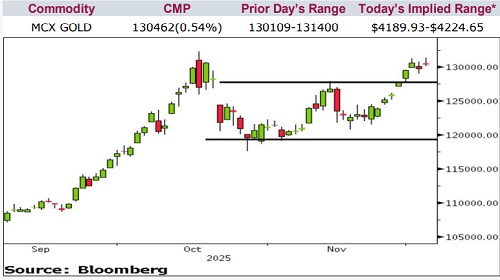

* Comex Gold ended little changed in the previous session, holding near the $4,200 mark. The ADP employment report came in weaker than expected, while the ISM services PMI surprised on the upside, reinforcing expectations of a rate cut later this month. Traders will keep a close eye on President Trump’s upcoming speech, consumer sentiment figures, and the Core PCE price index, all of which could inject volatility into the market over the course of the week

* Nymex Crude Oil edged higher by nearly 1% as support came from a softer dollar and renewed geopolitical tensions after US-Russian talks failed to make headway on the Ukraine conflict, keeping restrictions on Russian energy exports intact. Gains, however, were tempered by a marginal increase in US inventory data, which capped upside at higher levels

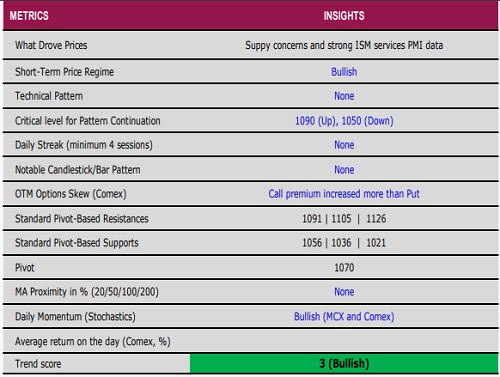

* Comex Copper posted strong gains of almost 3%, climbing to a multi-month high around $5.4 and marking a fresh record on MCX at 1,076. Supply-side worries, a weaker dollar, and rising prospects of policy easing bolstered sentiment across the industrial metals space

* Natural Gas extended its recent rally, surging close to 4% as prices approached multi-year highs near $4.9. The move was driven by robust export demand, with US LNG shipments jumping 40% year-on-year in November to 10.7 million tonnes. Europe’s decision to fully phase out Russian LNG by 2027 added further support. Demand expectations also firmed as forecasts pointed to a colder start to the North American winter, particularly across the Northeast and Great Lakes regions

Gold

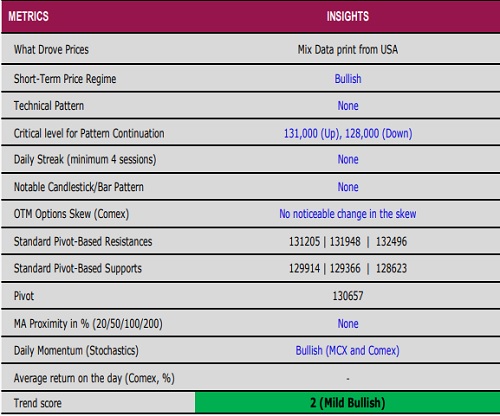

Silver

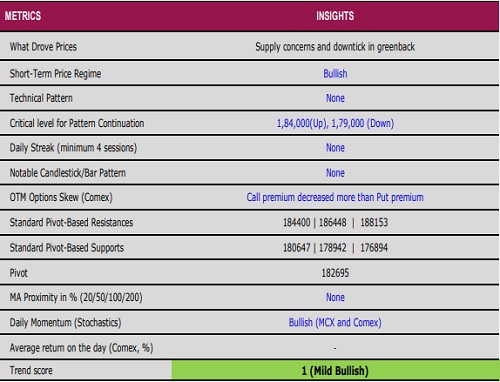

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633