Crude oil rose on Wednesday as the US vowed to reduce Iran`s energy exports to zero - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

* Gold hit another all-time high as warnings from Federal Reserve Chief Jerome Powell about the impact of the trade war fueled volatility on Wall Street, leading to sharp declines in stocks and the dollar.

* Spot gold gained nearly 3.5% on Wednesday in its biggest one-day gain since March 2023, as the dollar fell to a fresh six-month low. Traders were again whiplashed by a slew of tariff headlines, while Powell quelled hopes the Fed would act quickly to soothe investors, highlighting the unpredictability of tariff announcements from Washington.

* Crude oil rose on Wednesday as the US vowed to reduce Iran’s energy exports to zero. Secretary Scott Bessent said the US would apply maximum pressure to disrupt the OPEC member’s oil supply chain, as his department sanctioned a second Chinese refinery accused of handling crude from Iran. Furthermore, traders' sentiment improved following China signaling openness to trade negotiations with the US, though it set preconditions. Natural gas reached a new swing low and closed lower on Wednesday as increased production and a weak demand outlook pressured price.

* In the base metals, lead and zinc prices dropped as stockpiles held in London Metal Exchange warehouses in Singapore surged. Inventories of zinc rose by the most since 2015, and lead stocks hit a 12-year high, driven by inflows in Singapore, which has become the top storage location for both metals. Recovery was seen in copper during the evening session on Wednesday.

*Asian stocks rose slightly, and the yen weakened as investors gained confidence from the initial round of trade negotiations between the US and Japan.

Gold

Trading Range: 94750 to 96380

Intraday Trading Strategy: Buy Gold Mini May Fut at 94950 SL 94600 Target 95520

Silver

Trading Range: 94080 to 96980

Intraday Trading Strategy: Buy Silver Mini Apr Fut at 94800-94850 SL 94080 Target 95980/96300

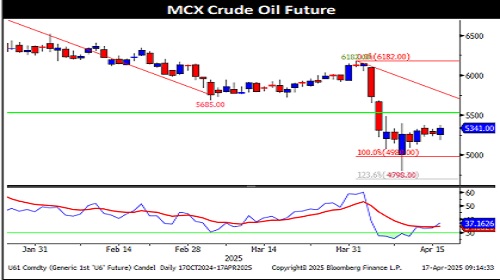

Crude Oil

Trading Range: 5280 to 5505

Intraday Trading Strategy: Buy Crude Oil Apr Fut at 5350 SL 5279 Target 5435/5500

Natural Gas

Trading Range: 266 to 288

Intraday Trading Strategy: Sell Natural Gas Apr Fut below 274 SL 280.0 Target 266

Copper

Trading Range: 826 to 850

Intraday Trading Strategy: Buy Copper Apr Fut at 836-837 SL 829.0 Target 845/850

Zinc

Trading Range: 244-255

Intraday Trading Strategy: Sell Zinc Apr Fut at 250.50 SL 253.20 Target 245

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133