CPI Inflation:Slight uptick but level stays benign; FY26E maintained at 1.9% by Emkay Global Financial Services Ltd

November headline inflation ticked up to 0.7%, driven by fading base effects and an uptick in food prices. Notably, some categories (prepared meals, nonalcoholic beverages, HH goods and services, and tobacco and intoxicants) are likely to have seen further pass-through of GST cuts. Core CPI dipped to 4.3% as gold (and silver) prices took a breather during the month, with core ex-gold rising to 3.4% as a result. December CPI is currently tracking at 1.6%, as base effects fade further and with food prices also increasing marginally. FY26E headline CPI forecast remains unchanged at 1.9%, with core CPI at 4.3%. With the RBI delivering a dovish cut in December, we do not rule out another rate cut in this cycle which is likely to be contingent on evolution of growth-inflation dynamics. We maintain our stance that the Rupee weakness will not constrain further easing but act as a natural stabilizer vs erosion of export competitiveness.

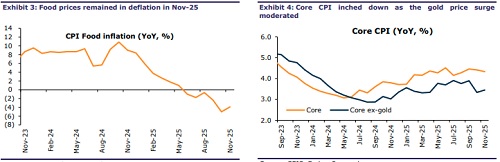

Headline CPI sees an uptick to 0.7% on fading base effect and higher food prices Headline CPI inflation rose to 0.71% in Nov-25 (Emkay: 0.8%, prior: 0.25%), with food price deflation continuing (F&B CPI: -2.8% YoY). Monthly momentum ticked up to 0.3% MoM (vs 0.15% prior), driven by prices of food (0.6% MoM). Within food, vegetable prices moved higher on the month (2.6% MoM), led by tomatoes (34% MoM); however, deep deflation persists on YoY basis. Other significant movers include eggs (5.2% MoM) and fruit (-0.9% MoM). Notably, various categories (non-alcoholic beverages, prepared meals, HH goods and services, and tobacco and intoxicants) are likely to have seen further pass-through of the GST cuts in November

Core inflation dips as gold surge moderates Core inflation (ex-intoxicants) dipped to 4.3% (vs 4.4% prior), with monthly momentum dropping to 0.1% (vs 0.5% prior). A pause in gold-price surge was the major reason for such moderation; gold prices rose only 1% MoM in Nov (vs 12% prior), with silver prices rising 1.8% (vs 22% prior). As a result, the Personal Care category rose only 0.5% MoM (vs 5.7% prior). Other core inflation categories rose 0.1-0.2% MoM, while Education declined 0.1%. With gold prices remaining subdued, core CPI ex-gold rose to 3.4% (vs 3.3% prior), with monthly momentum rising to 0.4%.

December CPI tracking higher at 1.6%; FY26E headline CPI unchanged at 1.9% Currently, December headline CPI is tracking at 1.6%, as the favorable base effect fades and given the uptick in food prices. FY26E headline CPI remains at 1.9%, slightly lower than the RBI’s (2%), while core CPI (ex-intoxicants) forecast is also unchanged, at 4.3%. FY27E headline CPI forecast is at 4.1%, with core CPI moderating to 3.9%

Terminal repo rate of 5% not ruled out; FX weakness unlikely to be a constraint While the RBI finally acknowledged the persistent inflation undershoots and delivered a 25bps cut in December, the Governor’s tone was also dovish, as he recognized that underlying price pressures are even softer once the effect of gold is stripped out. This added to the dovish tilt of the MPC, reinforcing the message of weak demand-side inflation drivers. The MPC also delivered tactically smart and flexible forward guidance (along with a much-needed liquidity boost), signaling openness to further easing, to avoid undermining monetary policy transmission. These factors imply that another rate cut is still in play, with the policy path ahead hinging on 1) how durable growth proves to be after the festive season and the GST-driven bump, 2) how strongly the inflation rebound is viewed in 2HFY27 by the RBI, 3) how strong are the contours (and timing) of the USIndia trade deal, if signed, and 4) how the FX market evolves. Importantly, we continue to argue that the Rupee softness should not be misconstrued as a constraint on further easing. Instead, it acts as a natural stabilizer for growth, especially as India faces a relative erosion of export competitiveness vis-à-vis EM Asia.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354