Copper Hits 5-Month High as China Pledges to Boost Consumption - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

* Gold touched a fresh all-time high at $3015.20 an ounce in the Asian trading hours on Tuesday as investors weighed US data that fueled concerns about an economic slowdown, while an escalation in Middle East tensions further underscored the precious metal’s haven appeal.

* Israel on Tuesday said it launched military strikes on Hamas targets in Gaza, a move that threatens to undermine a shaky truce. Traders were also digesting US retail sales data, which rose less than forecast in February, signaling consumer caution and lifting bets that the Federal Reserve will resume its rate-cutting cycle.

* Crude oil ended the session with a gain as bargain buying and escalating tensions in the Middle East overshadowed concerns about a potential global glut. US attacks on Yemen's Iran-backed Houthis and President Trump's comments have revived geopolitical tensions, which have increased the risk premium in oil prices.

* Natural gas gave up an early advance and settled moderately lower after US forecasts warmed for later this month, which will reduce heating demand for natural gas.

* Copper rose to the highest in five months after China vowed to revive consumption in the world’s largest consumer of the metal. The government unveiled a special action plan over the weekend aimed at boosting spending by increasing people’s incomes.

* Meanwhile, Chinese retail sales increased 4% in the first two months, exceeding forecasts. Consumption in the country grew faster at the start of the year, helping offset the impact of tariffs imposed by US President Donald Trump that are putting pressure on Chinese exporters.

Gold

Trading Range: 87900 to 88780

Intraday Trading Strategy: Buy Gold Mini Apr Fut at 88150-88175 SL 87900 Target 88480

Silver

Trading Range: 99650 to 102100

Intraday Trading Strategy: Buy Silver Mini Apr Fut at 100250 SL 99500 Target 101750.

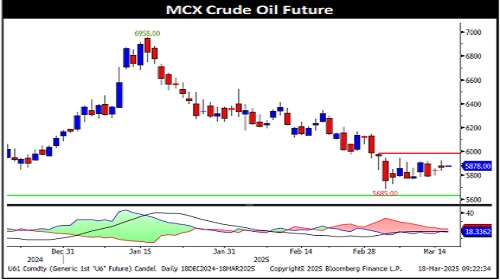

Crude Oil

Trading Range: 5780 to 5950

Intraday Trading Strategy: Buy Crude Oil Mar Fut at 5835 SL 5775 Target 5950

Natural Gas

Trading Range: 334 to 366

Intraday Trading Strategy: Sell Natural Gas Mar Fut at 356-357 SL 366.0 Target 345/337

Copper

Trading Range: 894 to 913

Intraday Trading Strategy: Buy Copper Mar Fut at 903 SL 897.8 Target 910

Zinc

Trading Range: 274-287

Intraday Trading Strategy: Sell Zinc Mar Fut at 280.0 SL 282.80 Target 275.50

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133