Consumer Discretionary - AlcoBev : Q2FY26 Quarterly Results Preview by Choice Broking Ltd

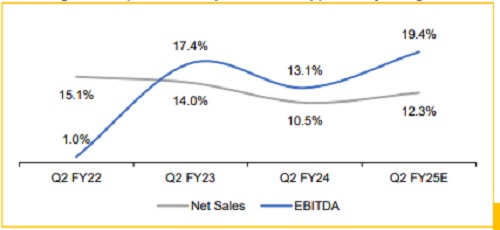

AlcoBev Industry EBTIDA Growth Outpacing Net Sales Growth

Overall AlcoBev Net Sales is expected to increase by 12.3% in Q2FY26E, with EBITDA growth moving up faster at ~19%. Raw Material cost has remained benign during the quarter, with no sharp increase expected for the full year as well. While GST rate rationalization does not directly impact the sector, we expect a rise in overall consumption leading to buoyancy in IMFL sales as well. Companies under our coverage are expected to report an average growth of ~16% in Q2FY26E volumes.

EBITDA growth expected to outpace sales, supported by benign RM cost

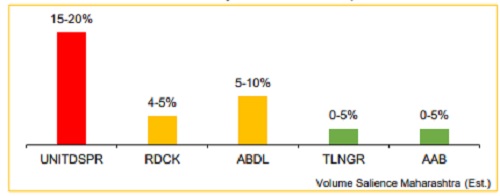

Mixed Regulatory Feedback for Industry

States, such as Uttar Pradesh and Delhi offer tailwinds to the AlcoBev sector with outperformance in excise collection and higher volume growth. However, certain larger states, such as Maharashtra (steep hike in excise), Telangana (credit overdue) offer headwinds for the sector.

UNITDSPR to be most affected by increase in IMFL prices in Maharashtra

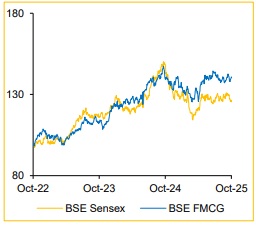

Sector View

We maintain our Positive View on the IMFL category within the AlcoBev space. Premiumization, rising disposable incomes and entry of large number of legal-drinking-age (LDAs) adults posits greater momentum, going forward. Our preferred ideas are: RDCK & ABDL.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Tag News

.jpg)

Quote on Pre-market comment for Monday March 02 by Aakash Shah, Technical Research Analyst a...

.jpg)