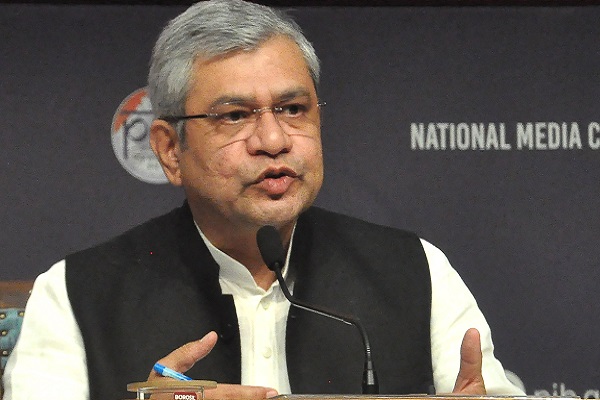

Quote on Pre-Market Comment 31th December 2025 by Aakash Shah, Technical Research Analyst, Choice Broking Ltd

Below the Quote on Pre-Market Comment 31th December 2025 by Aakash Shah, Technical Research Analyst, Choice Broking Ltd

Indian equity markets are likely to open flat to mildly positive on Wednesday, the final trading session of 2025, amid thin year-end volumes and mixed global cues. With several global markets either closed or operating with limited participation, domestic indices are expected to witness range-bound activity and muted volatility. Asian markets are trading mixed, while U.S. markets closed lower in the previous session, indicating a cautious undertone at the open. Stable crude prices and a steady rupee continue to provide underlying support, limiting sharp downside risks.

From a technical perspective, the Nifty 50 remains in a healthy consolidation phase within a broader uptrend. Immediate support is seen at 25,750–25,800, while resistance is placed near 26,050–26,100. A sustained breakout above resistance could open the path toward 26,200–26,300, whereas failure may keep the index confined to a narrow range.

The Bank Nifty is also consolidating after its recent rally, with key support at 58,800–58,900 and resistance at 59,400–59,500. A decisive move above resistance may trigger further upside, while a breakdown could prolong sideways action.

India VIX remains near multi-month lows, signaling limited intraday swings. Overall, the setup favors range-trading and buy-on-dips strategies, with strict stop-losses advised due to low liquidity and possible sudden volatility spikes.

Above views are of the author and not of the website kindly read disclaimer