Company Update : Buy Firstsource Solutions Limited by JM Financial Services Ltd

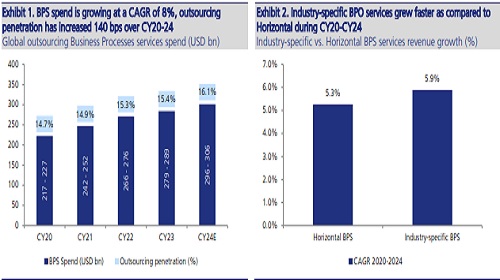

* GenAI - Risk or opportunity? Risk of genAI on BPO is considered to be the highest (Exhibit 26). It promises significant productivity improvement in repetitive tasks, potentially deflating revenue. Counterintuitively, however, pure-play BPOs have outpaced IT Services’ growth since the launch of ChatGPT (Exhibit 42). That is not an anomaly. BPO vendors are integrating AI – through partners and platforms – in their offerings, shifting to outcome-based pricing models and passing-on productivity benefits proactively. This, we believe, has widened their technology arbitrage versus clients’ in-house BPO teams, driving higher outsourcing. Outsourcing penetration in BPO is up 120bps over 2021- 24 (Exhibit 39). New use cases, e.g., data annotation is helping too.

* ‘One Firstsource’ for new Firstsource: Ritesh’s One Firstsource strategy addressed structural, cyclical and technological risks facing FSOL. The revamped GTM included assigning dedicated client partners to identify white spaces and proactively build a transformative deal pipeline. He set up a war room for new must-have logos. Technology in everything was a response to the genAI threat. The Chief Digital & AI officer, one of the CEO’s first hires, helped onboard 50 tech partners – from hyperscalers to start-ups. FSOL also built adjacencies – both organically and inorganically. It stepped up analysts/advisors engagement to bring unified capabilities to the market, helping break siloes.

* Unlocking potential: Ritesh’s accounts-centric, tech-led, self-sourced large deal focus was to unlock growth first. Results were immediate. FSOL reported its highest-ever deal ACV in FY24, only to exceed it by 60% in FY25. The average size of large deals rose by 40%, aided by a USD 50mn+ BPaaS deal, reflecting a proactive shift towards outcomebased engagements. FSOL is consistently winning against larger as well as smaller undifferentiated players. These are strong underpinnings for predictable, consistent growth. FY26 organic growth guidance of 10- 12% cc, on top of 15% cc organic growth in FY25 underscores this. With initial investments in sales/leadership behind, margins should improve too.

* Initiate coverage with ADD; TP of INR 370: We build 13% USD revenue CAGR and 200bps EBIT margin expansion over FY25-28E, driving 25% EPS CAGR. FSOL’s diversified and relatively de-risked portfolio lends earnings visibility. We, therefore, value the stock at 25x, in line with listed Indian BPO players, reasonable in our view. We initiate with ADD and a TP of INR 370.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361