Commodity Weekly Insights 24th Nov 2025 by Axis Securities

The Week That Was

• Gold prices held steady on Friday after falling more than 1% earlier in the session, as traders increased bets on a December U.S. rate cut following dovish comments from Federal Reserve officials. New York Fed President John Williams said the central bank could still lower rates soon without jeopardising its inflation mandate. Rate-cut expectations rose to 70%, up from 46% earlier in the day. The delayed U.S. jobs report painted a mixed picture, with nonfarm payrolls rising by 119,000 in October—well above estimates of 50,000—while the unemployment rate climbed to a four-year high.

• Crude oil and gasoline prices slipped to four-week lows, pressured by a stronger dollar that hit a 5.5-month high. Sentiment weakened further after Ukrainian President Zelenskiy signalled willingness to work on a U.S.–Russia–drafted peace plan, though prices later pared losses as Ukraine and its European allies rejected key elements of the proposal. At its 2 nd November meeting, OPEC+ confirmed members will raise output by 137,000 bpd in December before pausing hikes in Q1CY26 due to expectations of a global supply surplus.

• Natural gas prices jumped to a one-week high and settled sharply higher on forecasts for colder U.S. weather in late November and early December, boosting expectations for heating demand. Atmospheric G2 reported a shift toward colder temperatures across the West and Northeast for 26-30th November and across the central U.S. for 1-5 th December. High U.S. output remains a limiting factor. The EIA recently raised its 2025 production forecast by 1% to 107.7 bcf/day, and current production is near record levels, with active rigs at a two-year high.

• Copper futures fell below $4.95 per pound, touching a two-week low amid signs of softer demand in China and expectations that the Fed will keep rates unchanged in December. China continues to face headwinds from its prolonged property slump and slower power-grid spending. Reports indicate Beijing may introduce new measures to support the weak real estate sector. China’s copper cathode imports fell 22.1% YoY in October and were down 15.7% from September. The metal also came under pressure from Fed signals pointing to a cautious policy stance amid economic uncertaint

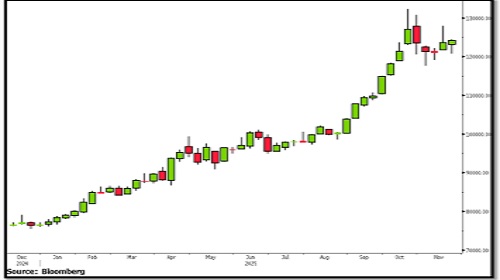

MCX Gold

Technical Outlook:

MCX Gold ended last week nearly flat, posting a marginal gain of 0.5%. Despite the heightened volatility, it still managed to secure another positive weekly close. The broader structure continues to signal a buy-on-dips approach. A decisive breakout above Rs 1,25,000 could accelerate upside momentum toward Rs 1,30,000 and Rs 1,33,000. On the downside, Rs 1,21,500 remains a strong support zone. Prices also continue to trade above the 20- and 50- day moving averages, reinforcing the positive undertone.

Recommendation:

We recommend buying MCX Gold above Rs 1,25,000, with a stoploss below Rs 1,21,000 and targets of Rs 1,30,000 and Rs 1,33,000.

Current Market Price (CMP): Rs 1,24,195

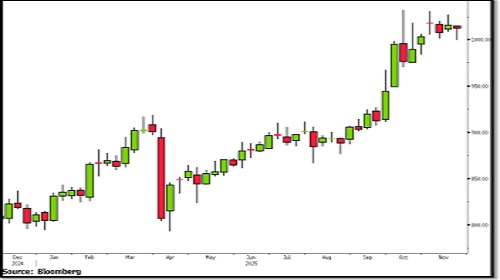

MCX Silver

Technical Outlook:

MCX Silver experienced a highly volatile week, finishing with a loss of nearly 1.2%. On the monthly chart, the trend remains firmly bullish and continues to indicate opportunities to buy on dips. A breakout above Rs 1,60,000 may open the door for a move toward Rs 1,66,000 and Rs 1,70,000 in the coming sessions. Major support is placed at Rs 1,48,000; a breakdown below this level could trigger fresh short positions. The weekly RSI is hovering around 75, suggesting overbought conditions.

Recommendation:

We recommend buying MCX Silver above Rs 1,60,000, with a stop loss below Rs 1,55,000 and targets of Rs 1,66,000 and Rs 1,70,000

Current Market Price (CMP): Rs 1,54,052

MCX Crude Oil

Technical Outlook:

MCX Crude Oil continues to form lower highs and lower lows on the weekly chart, confirming a sell-on-rise structure. A breakdown below Rs 5,100 may extend the decline toward Rs 4,800 and Rs 4,600. Strong resistance is seen at Rs 5,500, and unless prices break above this zone, crude oil is expected to remain under bearish pressure. The RSI is currently near 43 and trending lower, which adds to the negative outlook.

Recommendation:

We recommend selling MCX Crude Oil below Rs 5,100, with a stop-loss above Rs 5,300 and targets of Rs 4,800 and Rs 4,600.

Current Market Price (CMP): Rs 5,199

MCX Copper

Technical Outlook:

MCX Copper closed the week flat after recovering most of its early losses. The metal is encountering strong resistance near Rs 1,030, which it has repeatedly failed to breach. Price action suggests a consolidation phase, with key support at Rs 990 and resistance at Rs 1,030. Copper remains above its 20- and 50- week moving averages, which is a constructive sign. The weekly RSI, at 71, reflects sustained bullish momentum

Recommendation: We recommend buying MCX Copper above Rs 1,030, with a stop-loss below Rs 1,010 and targets of Rs 1,060 and Rs 1,080.

Current Market Price (CMP): Rs 1,012

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633