Commodity Weekly Insights 19th January 2026 by Axis Securities

• Gold prices fell around 1% to near $4,560 per ounce on Friday, extending the previous session’s losses as safe-haven demand eased and expectations for near-term Federal Reserve rate cuts weakened. Geopolitical tensions around Iran moderated after President Donald Trump indicated that any potential military action could be delayed, citing signs that the crackdown on protests was easing and that large-scale executions would not proceed. Stronger US economic data further reinforced expectations that monetary policy will remain restrictive for longer, prompting investors to scale back bets on an imminent Fed cut.

• Silver slumped more than 4% to below $88.7 per ounce, deepening its sharp pullback after recent volatility. The decline followed the US decision not to impose tariffs on critical minerals, removing a key bullish catalyst. Earlier tariff concerns had triggered a strong rally across commodities as traders rushed shipments into the US. The correction was amplified by broad-based profit booking in precious metals, easing geopolitical risks, and a firmer US dollar, which reduced the appeal of non-yielding assets.

• WTI crude oil futures edged up 0.4% to settle at $59.4 per barrel, ending the week with gains of over 1%. Prices remained volatile as markets balanced lingering geopolitical risks against easing fears of an immediate US strike on Iran. Oil had earlier touched multi-month highs amid concerns that unrest in Iran could disrupt its roughly 3.3 Mn barrels per day output. Prices pared earlier losses after reports suggested a delay in US intervention, even as Washington continues to increase its military presence in the region.

• Copper futures declined to around $5.9 per pound, extending losses for a second straight session after China announced tighter measures on high-frequency trading to reduce risks in its capital markets. Regulators directed domestic exchanges to remove high-frequency trading servers from their data centres, curbing speed advantages. Copper prices across Shanghai, London, and New York retreated further from record highs and were also pressured by the US decision to defer tariffs on critical minerals.

• Natural gas prices settled lower on Friday but remained above Thursday’s three-month low of the nearest futures contract. Abundant US supply continued to weigh on prices after the latest EIA report showed storage levels 3.4% above the five-year seasonal average. Losses were partially capped by forecasts for colder-than-normal US temperatures, which could lift heating demand. The EIA report was bearish overall, as inventories for the week ending 9 th January fell by 71 bcf, well below market expectations of a 91 bcf draw and the five-year average draw of 146 bcf.

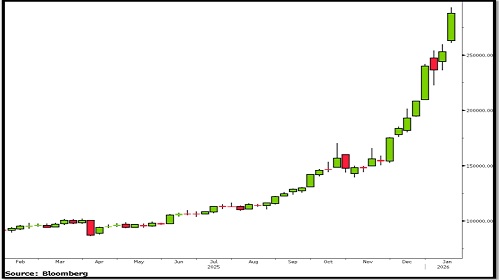

MCX Gold

Technical Outlook:

MCX Gold continues to trade in a well-defined uptrend on the weekly chart, characterised by a series of higher highs and higher lows. Prices closed the week with a strong bullish candle, reinforcing a positive near-term outlook. A sustained breakout above the Rs 1,43,600 level could open the door for further upside toward the Rs 1,47,000 and Rs 1,49,000 zones in the coming weeks. On the downside, Rs 1,36,000 remains a critical support. A decisive break below this level could trigger fresh selling pressure, potentially leading to a deeper correction toward the Rs 1,32,000– 1,30,000 region.

Recommendation:

We recommend buying MCX Gold above Rs 1,43,600, with a stoploss below Rs 1,41,000 and targets of Rs 1,47,000 and Rs 1,49,000.

Current Market Price (CMP): Rs 1,42,600

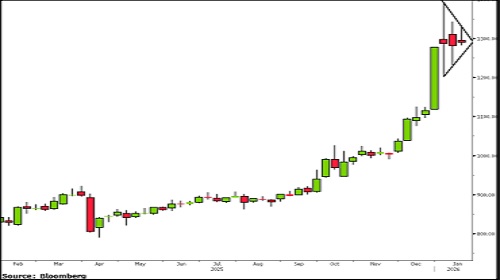

MCX Silver

Technical Outlook:

MCX Silver posted a sharp weekly gain of nearly 14%, forming a large bullish candle and maintaining a positive price structure. The broader trend remains bullish, and a breakout above Rs 2,93,000 could extend the rally toward the Rs 3,05,000 and Rs 3,13,000 levels in the near term. However, the weekly RSI is hovering around 92, indicating overbought conditions and the possibility of short-term consolidation. Strong support is placed near Rs 2,60,000; however, a breakdown below this level may invite renewed selling pressure.

Recommendation:

We recommend buying MCX Silver above Rs 2,93,000, with a stop-loss below Rs 2,83,000 and targets of Rs 3,05,000 and Rs 3,13,000.

MCX Crude Oil

Technical Outlook: MCX Crude Oil registered another weekly gain of 1.4%, though prices failed to sustain above the key consolidation resistance near Rs 5,500. Going forward, a decisive move above Rs 5,620 could confirm a breakout and drive prices toward the Rs 5,900 and Rs 6,100 levels in the coming days. The daily RSI continues to form higher highs, signalling strengthening momentum and a potential trend reversal. On the downside, the Rs 5,000 level remains a strong support.

Recommendation:

We recommend buying MCX Crude Oil above Rs 5,620, with a stop-loss below Rs 5,400 and targets of Rs 5,900 and Rs 6,100.

Current Market Price (CMP): Rs 5,450

MCX Copper

Technical Outlook: MCX Copper ended the week marginally lower by 0.7%, continuing to trade within a tight consolidation range between Rs 1,345 and Rs 1,265. A breakout on either side of this range is likely to set the next directional move. The daily momentum indicator is forming lower lows, suggesting an increasing bearish bias. A decisive break below Rs 1,265 could accelerate selling pressure, with downside targets set at Rs 1,200 and Rs 1,170.

Recommendation:

We recommend selling MCX Copper below Rs 1,265, with a stop-loss above Rs 1,310 and targets of Rs 1,200 and Rs 1,170.

Current Market Price (CMP): Rs 1,290

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Buy TURMERIC JUN @ 13800 SL 13500 TGT 14200-14400. NCDEX - Kedia Advisory