Commodity Weekly Insights 16th September 2025 by Geojit Financial Services Ltd

Silver spot prices surged to 14-year high in September, fuelled by the global shift toward green energy, especially solar power, alongside heightened geopolitical tensions and economic uncertainty, which have driven strong safe haven demand for the metal.

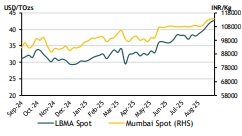

* Spot silver hit a near fourteen year high of USD42.78 a troy ounce, posting above 47% gain so far in 2025.

* In MCX, front month silver futures gained more than 13% over the last monthly period, surging to all time high.

* Weak Indian rupee accelerated the rally in silver prices in the domestic market.

* India’s silver imports went up 320% in May to 433 tonnes against 103 tonnes in the same month last year.

* Global silver demand is expected to remain broadly stable in 2025 at 1.20 billion ounces. International Silver Institute

* Global silver ETF physical holdings reached 1.13 billion troy ounces in June, just 7% below their highest level since the peak of 1.21 Billion troy ounces in February 2021.

* Total global silver supply is forecast to grow by 3% in 2025 to an 11-year high of 1.05 billion ounces.

* Silver physical investment is also forecast to rise by 3%, while demand for jewellery demand is expected to decline by 6%.

* US FOMC expected to cut the interest rates by 25 bps to 4.00- 4.25% in the September meeting.

* Global equities were broadly over positive territory in the last week.

* US dollar edged lower against a basket of six rivals on expectation of a dovish move by Federal Reserve.

* Euro, Chinese yuan ticked up while Japanese yen eased against USD last week.

* Indian Rupee plunged to all time low against USD to near 88.27 points last week.

Silver spot traded firm above 14-year high amid global shifts in Energy and Investment Trends

Silver spot has surged over 47% so far in 2025 to a 14-year high, on robust industrial and investment demand, even as jewellery consumption has softened across key physical markets. A major catalyst has been the accelerating global shift toward renewable energy, particularly solar power, which continues to drive substantial demand for silver due to its critical role in photovoltaic technologies. The "go green" movement, once concentrated in major economies, is now gaining traction in smaller nations, further amplifying interest in industrial metals. Simultaneously, heightened geopolitical tensions and economic uncertainties have prompted investors to seek safe-haven assets, with silver benefiting from bullish sentiment and optimistic price forecasts. Together, these factors have positioned silver as a key beneficiary of both structural energy transitions and evolving macroeconomic dynamics.

Fed meeting awaited, 25 bps cuts expected in this meeting

At its upcoming policy meeting on September 16–17, the Federal Reserve is widely expected to lower interest rates by 25 basis points, bringing the target range to 4.00–4.25%. Although U.S. inflation rose 2.9% year-on-year in August, a sharp decline in monthly job growth and a spike in initial jobless claims have reinforced expectations for a rate cut. During last month’s Jackson Hole symposium, Fed Chair Jerome Powell signaled the possibility of easing monetary policy in September, though he stopped short of a firm commitment. His remarks highlighted the Fed’s ongoing challenge of navigating a weakening labor market amid persistent inflationary pressures.

LBMA Vs Mumbai Spot Prices

Gold - Silver Ratio

Global Silver Investment seen strong in 2025

According to The Silver Institute, global silver investment saw robust growth in the first half of 2025, driven by strong inflows into silver-backed exchange-traded products (ETPs) and resilient retail demand in key markets. ETPs attracted net inflows of 95 million ounces, surpassing the total for all of 2024, with holdings reaching 1.13 billion ounces and exceeding USD40 billion in value for the first time.

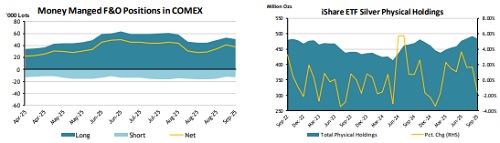

COMEX Money Managers reduced net longs in Silver F&O

Data from U.S. Commodity Futures Trading Commission (CFTC) showed that the hedge funds and money managers reduced net long positions in COMEX silver Futures and Options contracts in the week ended 13 September.

iShare Silver ETFs holdings eased in September after strong inflows for 6th month in August

Total physical holdings of Silver backed ETFs with iShare silver trust eased by 1.63 percent MoM in September after the strong inflows for a sixth straight month till August, by 1.64 percent MoM. The total physical holdings in silver with iShare silver trust is around 484.18 million troy ounces in the week ended 13 September.

Gold - Silver Ratio increased to 86.45 ounces

Gold/Silver Ratio is the amount of silver it takes to purchase one ounce of gold.

Outlook

Silver prices are expected to remain supported by a softer US dollar, as the Federal Reserve moves toward an interest rate cut. Following a strong first half, physical silver demand is projected to hold steady through 2025, with solid contributions from industrial applications and retail investment offsetting weaker jewelry and silverware consumption. On the supply side, global output is forecast to rise by 3%, primarily driven by a rebound in mine production. Meanwhile, renewed geopolitical tensions in Ukraine and the Middle East continue to fuel safe-haven demand, while sustained industrial growth, especially from the expanding green energy sector, is likely to provide a firm price floor.

Technical View

LBMA Spot: The bullish divergence in MACD oscillators indicates prevailing positive sentiments, while the RSI remains at overbought territory suggests subdued buying pressure. Prices the possibility for a profit booking liquidation still on the table. However, a corrective dip below $39/oz may indicate a near term reversal.

MCX Silver: Positive momentum is expected to persist, though brief corrective pullbacks may occur. A decisive drop below the ?123,500/ kg level could signal a short term reversal in the prevailing upward trend.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034

Tag News

Evening Roundup : A Daily Report on Bullion Energy & Base Metals for 16th September 2025 - G...