Commodity Morning Insights 28th November 2025 - Axis Securities

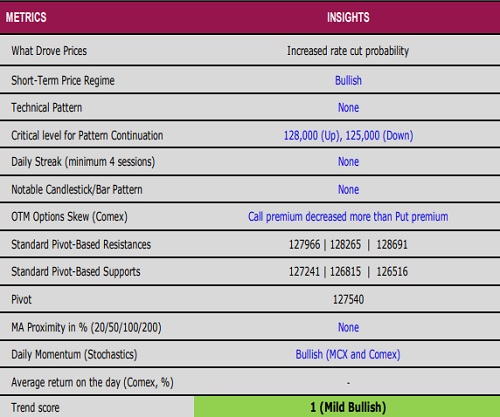

* Comex Gold extended its gains in the last session, closing above $4,160 and hovering near a two-week high. The near-term trend remains constructive as rising expectations of a Fed rate cut continue to support bullion. A breakout above the downward-sloping trendline adds to the bullish setup. As long as prices hold above $4,150, an advance toward $4,240 appears likely

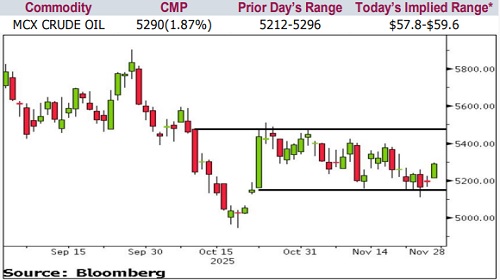

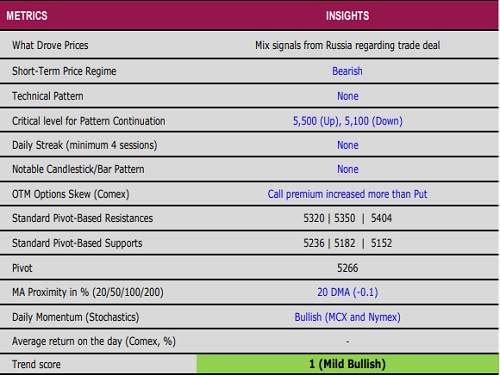

* Nymex Crude Oil edged higher nearly 1% higher, with broader risk sentiment improving on renewed rate-cut expectations. Hopes that OPEC+ may keep production unchanged at the upcoming meeting are also providing support on declines. On MCX, as long as the ?5,100 support zone remains intact, crude is expected to trade with a positive bias in the near term

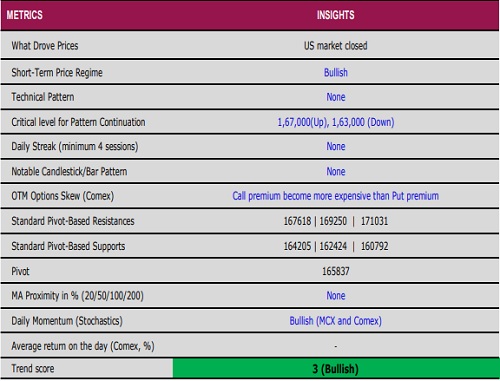

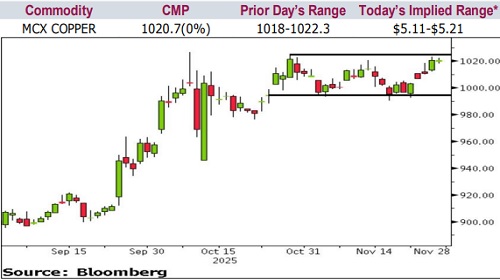

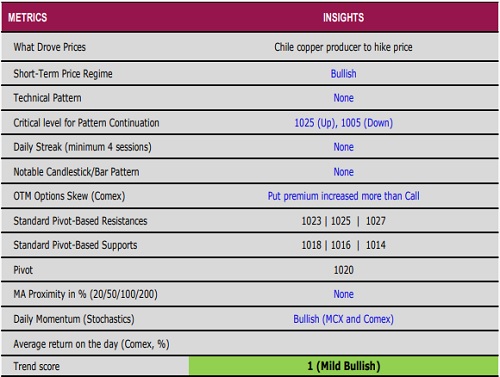

* Comex Copper moved in a narrow range amid thin participation, with US markets closed for Thanksgiving. The underlying tone stays firm, supported by ongoing supply concerns across key producing regions

* Nymex Natural Gas ended flat as the holiday-driven lull kept activity muted. Even so, the short-term outlook remains positive with colder weather forecasts expected to lend support to prices.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)