Commodity Morning Insights 17th September 2025 - Axis Securities

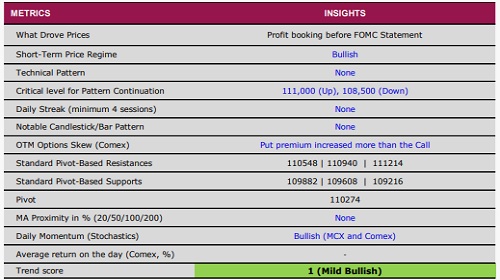

* Comex Gold climbed to a record high of $3,703 in the previous session but was unable to sustain those levels, eventually settling with a modest gain at $3,689 ahead of the FOMC statement due later tonight. Market participants will closely watch the Fed’s quarterly Summary of Economic Projections, particularly the dot plot, along with Chair Jerome Powell’s press conference, for further cues on the policy outlook

* Nymex Crude Oil extended its rally for a third consecutive session, advancing nearly 2% as supply concerns intensified following a Ukrainian drone strike on a Russian oil refinery, while a weaker dollar also provided support

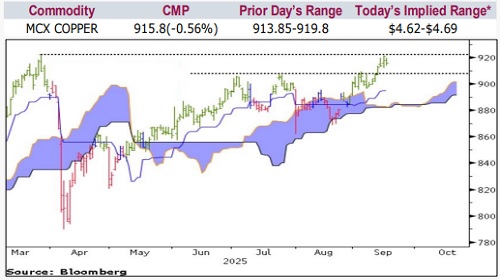

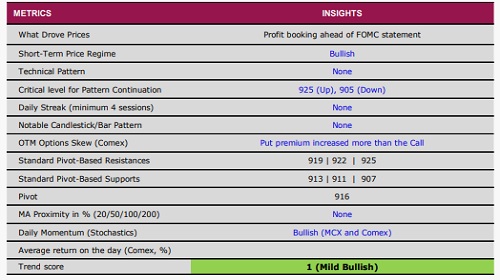

* Comex Copper eased by 0.4% from its multi-month high in the last session, weighed down by profit-taking ahead of the FOMC statement. Nonetheless, the broader outlook for the metal remains constructive as a softer dollar and expectations of a potential rate cut are likely to underpin prices at lower levels

* Nymex Natural Gas gained more than 2% in the previous session, buoyed by forecasts of warmer weather, which is expected to drive higher demand for air conditioning

Gold

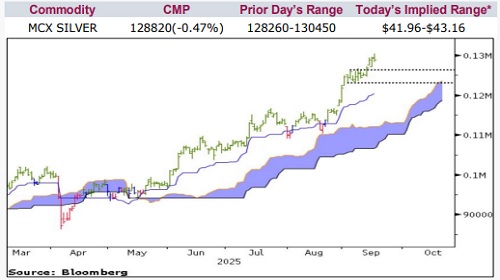

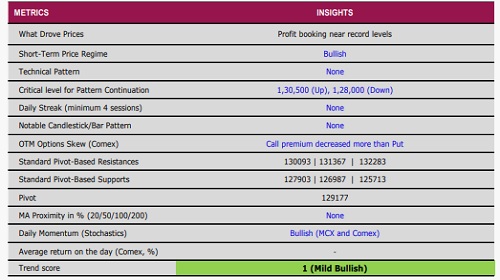

Silver

Crude Oil

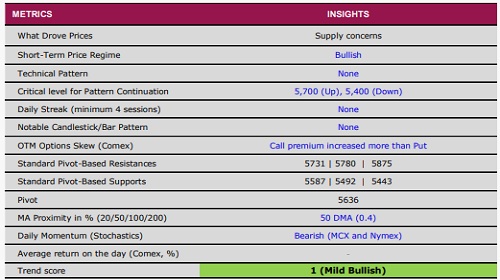

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633