Commodity Morning Insights 08th October 2025 by Axis Securities Ltd

* Comex Gold climbed nearly 1% in the previous session, supported by renewed safe-haven demand amid the ongoing U.S. government shutdown, escalating geopolitical tensions, and a softer Dollar Index. Spot prices inched closer to the historic $4,000 mark for the first time. The near-term trend remains positive as long as the $3,900 level acts as support

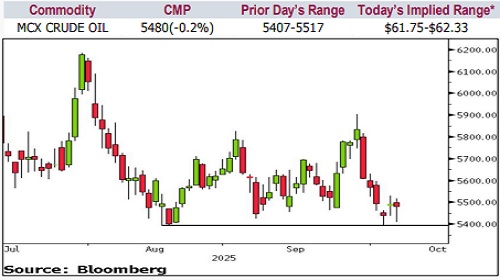

* Nymex Crude Oil rose by over 0.5% after a modest output hike by OPEC+, which helped stabilise prices at lower levels. Persistent supply concerns linked to the Russia–Ukraine conflict also lent support. Market participants now await the U.S. inventory data due later today, which could trigger a directional move depending on the outcome

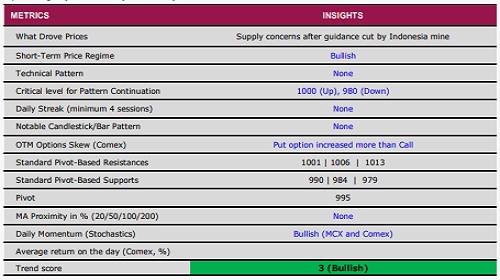

* Comex Copper closed nearly 1% higher, buoyed by supply disruptions in major producing regions such as Indonesia and Chile. All workers reported missing after last month’s accident at Indonesia’s Grasberg mine have been confirmed dead, and operator Freeport-McMoRan indicated that full-scale production may not resume until early 2027, cutting its 2026 sales outlook by 35%

* Nymex Natural Gas extended its rally for a second consecutive session, gaining more than 3.5% amid lower production levels, strong LNG feedgas demand, and weather-related consumption expected later this month. The upcoming U.S. storage report is likely to show another below-average build, though inventories may start rising again in the following weeks

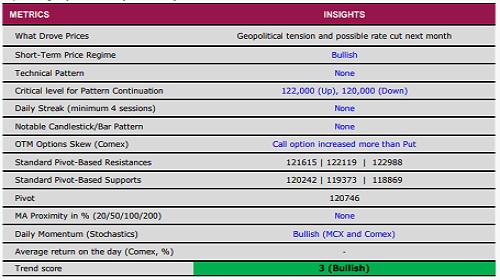

Gold

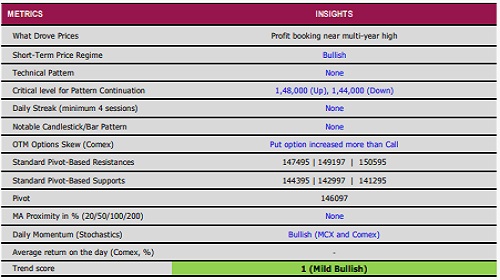

Silver

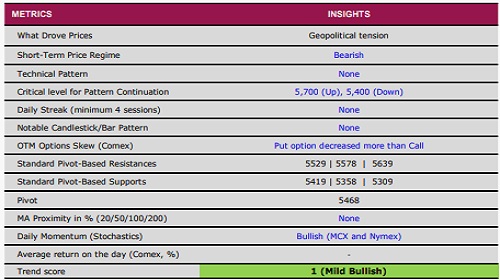

Crude oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633