Commodity Morning Insights - Axis Securities

Commodity Derivatives Snapshot

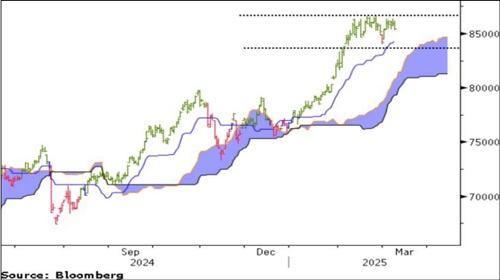

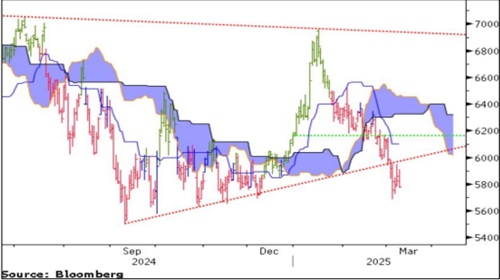

* Comex Gold declined by 0.7% in the last session as the U.S. Dollar Index snapped its five-day losing streak, edging up by 0.04%. With the upcoming CPI data release, bullion prices are expected to remain volatile this week

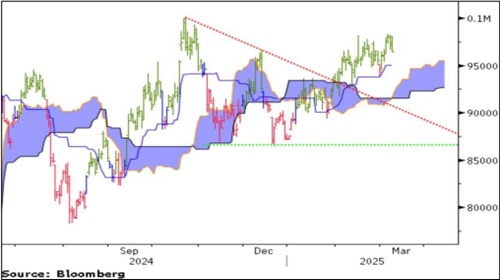

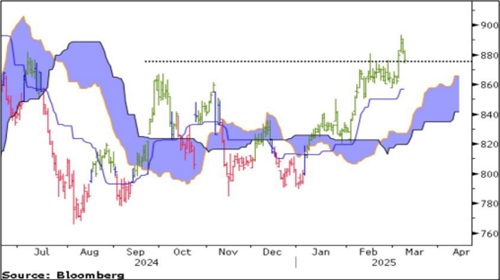

* Nymex Crude Oil fell over 1.6% in the last session, pressured by concerns that U.S. tariffs on Canada, Mexico, and China could slow global economic growth and weaken energy demand. Additionally, rising supply from OPEC+ further weighed on prices

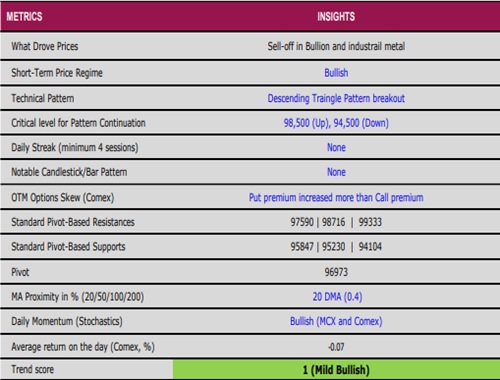

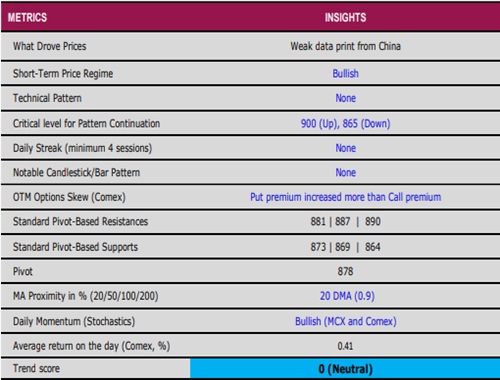

* Comex Copper extended its losing streak for the third consecutive session, dropping more than 1.4% as weak economic data from China dampened market sentiment. Weekend reports showed a decline in China’s consumer and producer prices for February, highlighting persistent deflationary pressures in the world’s largest copper consumer

* Nymex Natural Gas surged to a two-year high, driven by record LNG exports and supply concerns ahead of the summer season. The market remains on edge due to tightening supply conditions and the added risk of potential tariffs. Threats from Canada have further fueled the price surge, keeping volatility elevated.

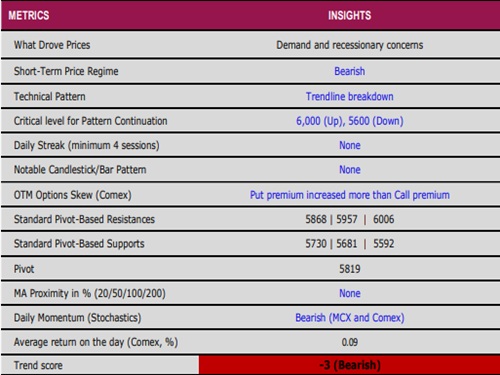

Gold

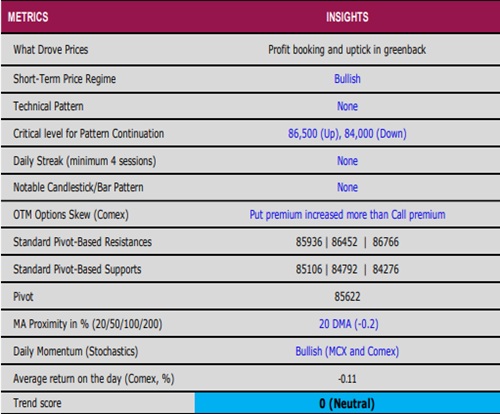

Silver

Crudeoil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633