Buy RBL Bank Ltd For Target Rs. 190 By Yes Securities Ltd

Our view – NPL formation peaks, normalization to follow in some time

Asset Quality – Gross slippages increased further from already elevated levels but management has called a peak and flagged a downward glide path:

Gross NPA additions amounted to Rs 13.1bn for 3QFY25, translating to an annualized slippage ratio of 6.0% for the quarter. Gross NPA additions had amounted to Rs 10.3bn during 2QFY25. Credit cards contributed Rs 5.67bn and Microfinance Rs 5.36bn to gross slippage. Management stated that overall slippages will trend lower and normalization is expected in 1Q or 2Q. Credit card slippages would trend lower in 4Q itself. Microfinance slippages will be similar or marginally lower in 4Q. Provisions were Rs 11.9bn, up by 92% QoQ and by 160% YoY, translating to calculated annualised credit cost of 533bps. As against the normalized provision of 25% which translates to Rs 2.59bn, the bank has taken additional provision of Rs 4.14bn towards NPA for JLG loans, totalling to Rs 6.80bn. For credit cards, the net provision taken was Rs 4.73bn.

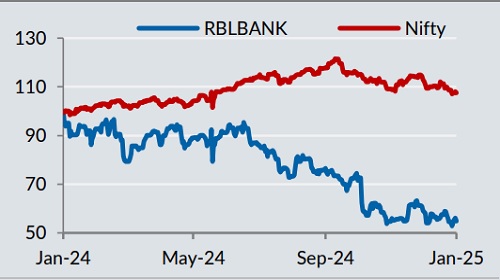

Stock performance

Balance sheet growth – Loan growth slowed to 13% YoY, which management flagged the bank would maintain by the end of the financial year:

Advances grew 2.9%/13.0% QoQ/YoY, driven sequentially by secured retail loans and Wholesale loans. Loan growth will be driven by the wholesale and secured retail loan segment. The bank would do large corporate business with only those clients who give them allied business like liabilities, trade finance, salary accounts, forex and others.

Net Interest Margin – Margin declined on sequential basis due to interest reversals and unfavourable loan mix evolution:

NIM at 4.90% was down -14bps QoQ. Reasons for lower NIM included lower disbursement of high margin JLG business and higher slippages leading to interest reversal of Rs 1.34bn in 3Q.

We maintain a recently-assigned ‘BUY’ rating on RBL with a revised price target of Rs 190:

We value the bank at 0.7x FY26 P/BV for an FY25/26/27E RoE profile of 4.5%/8.5%/9.7%.

Other Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio was at 62.5% down by -170/-455bps QoQ/YoY and the Cost to assets was at 4.7% flat QoQ but down -29bps YoY.

* Fee income: Core fee income grew 6.0%/19.5% QoQ/YoY, sequentially driven higher by Processing Fees and General Banking Fees.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632