Buy One 97 Communications Ltd For Target Rs. 1,350 By Emkay Global Financial Services Ltd

One 97 Communications (Paytm) has relaunched its Postpaid product in the form of a credit line (CL) on UPI, in partnership with Suryoday Small Finance Bank. At its peak, Paytm Postpaid volume was Rs30bn per month, which resulted in estimated annualized EBITDA of Rs2.5-3.5bn. RBI’s crackdown on small-ticket personal loans and subsequent challenges due to the PPBL issue compelled Paytm to discontinue the product. With NPCI guidelines allowing MDR on credit lines on UPI for a certain set of transactions, we expect the unit economics to be the same as or slightly inferior to the erstwhile product’s. A frictionless experience, low charges, and ubiquitous acceptance network are the key to success for such a product. As Paytm has started with a small set of users, merchant awareness for CL on UPI is low; due to this and the relatively smaller bank partner, we will watch the company’s scale-up before incorporating this development into our estimates. If Paytm reaches 50% of the erstwhile scale by Q4FY26, we expect 10.4% increase in FY27E EBITDA. We maintain a positive stance on the company, considering its strong execution in merchant payments and loan distribution, along with various optionalities. We reiterate BUY on the stock, with DCF-based target price of Rs1,350.

CL on UPI can democratize revolving credit for the masses

CL on UPI allows consumers to pay across UPI merchant touchpoints using a preapproved revolving credit line rather than debiting a bank account. Credit limits are riskbased, determined by the bank, basis a customer’s credit profile. Use cases include instore QR purchases, online checkouts, and bill payments, while P2P transfers are not permitted. Repayments are made on a billing-cycle basis, after which the limit is restored. Paytm is rolling out the product to a selected base, with broader expansion to follow. Paytm will be charging a small convenience fee (1-3%) for payments, while there will be MDR for large merchants as well as for small merchants for transactions above Rs2,000. Digital onboarding for CL on UPI can bring down the cost of enabling revolving credit to a large set of customers, thereby creating credit history for such customers. While we expect the savvy consumer to stay with the RuPay credit card for UPI, CL on UPI represents a large incremental opportunity given India’s small credit-cards base.

Outlook and Valuations – Various optionalities; reasonable valuations

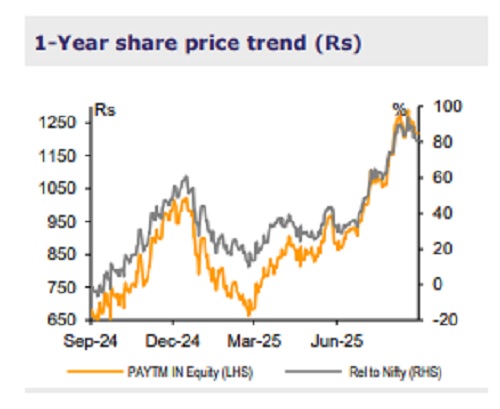

Paytm stock has fared well on the back of strong execution helping recoup its profitability status. CL on UPI reopens a higher-margin profit pool for Paytm. While we watch its scale-up, we believe there are various optionalities—scale-up in RuPay credit cards, bringing back wallet, and MDR on UPI for larger merchants. One can debate about the probability of each option, though some (if not all) will fructify in the mid-to-long term, and result in higher EBITDA. Given this and the strong growth momentum, valuations at 32x FY28E EV/EBITDA are attractive. We retain BUY with DCF-based TP of Rs1,350

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354