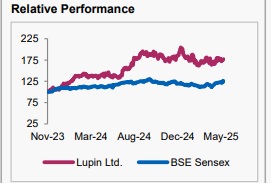

Buy Lupin Ltd For Target Rs. 2,500 - Axis Securities Ltd

Est. vs. Actual for Q4FY25: Revenue – INLINE; EBITDA Margin – BEAT; PAT – BEAT

Changes in Estimates (%) post Q4FY25

FY25E/FY26E: Revenue: 4.4%/3.8%; EBITDA Abs: 7.1%/4.7%; PAT: 5.8%/3.1%

Recommendation Rationale

A strong set of results: Lupin reported a strong set of results that exceeded expectations. Reported revenue increased by 14% YoY, driven by solid growth in the India and US businesses, which rose 19% and 7% YoY, respectively. The EMEA business also posted robust growth of 30% YoY. However, the Other Developed Markets segment grew by 10.7% YoY, while the API segment declined by 10.3% YoY.

Improvement in gross margin: The company’s gross margin improved by 200bps YoY and remained flat QoQ, driven by a favourable product mix, lower input costs, a reduced share of in-licensed products, and increased cost efficiencies.

EBITDA margins improved by 320bps YoY and remained flat QoQ. Reported PAT grew by 39.5% YoY, surpassing expectations.

Sector Outlook: Positive

Company Outlook & Guidance: Lupin has a strong pipeline of niche products that could support double-digit growth in the US market. Injectable products such as Glucagon and Dalbavancin, with a market opportunity of $500 Mn, are expected to launch within the next six months. Additionally, Liraglutide and Risperidone are likely to contribute to revenue in FY27E. The company is also exploring opportunities in biosimilars, including Ranibizumab and Aflibercept, while Tolvaptan (180 days Exclusivity) is expected to contribute to revenue in the generic segment in 1HFY26.

Current Valuation: 29x PE for FY27 earnings

Current TP: Rs 2,500/share; ( Earlier TP: Rs 2,500/share)

Recommendation: BUY

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633