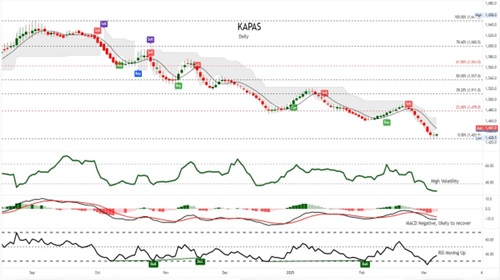

Buy Kapas Apr @ 1445 SL 1435 TGT 1455-1465. NCDEX - Kedia Advisory

Cottoncandy

BUY COTTONCANDY MAR @ 52800 SL 52500 TGT 53100-53400. MCX

Cottoncandy prices settled 0.65% higher at 52,890, tracking gains in ICE cotton prices amid rising US cotton exports and improved demand. Agricultural commodities, including cotton, benefited from reduced concerns over the tariff war, supporting market sentiment. However, upside potential was limited due to an overall increase in supply and subdued mill buying, as mills remain well-stocked with no immediate purchasing requirements. On the supply side, Brazil’s 2024-25 cotton production is projected to rise by 1.6% to 3.7616 million tons, with a 4.8% expansion in cotton planting area, signaling strong global supply potential. In India, the Cotton Association of India (CAI) estimated a decline in cotton output for the 2024-25 season to 301.75 lakh bales, down from 327.45 lakh bales in the previous season, due to lower yields in Gujarat and northern states. Total cotton supply until January 2025 was estimated at 234.26 lakh bales, including fresh pressings, imports, and opening stocks. Consumption until January stood at 114 lakh bales, while exports were 8 lakh bales. Ending stock for January was pegged at 112.26 lakh bales, with 27 lakh bales held by textile mills. CAI maintained its domestic consumption projection at 315 lakh bales for the season, while exports are expected to drop to 17 lakh bales from 28.36 lakh bales in 2023-24. Technically, the market is under short covering, with open interest declining by 2.33% to 251 contracts while prices gained 340 rupees. Cottoncandy has support at 52,780, with a potential test of 52,680 on the downside. Resistance is seen at 52,960, and a breakout above could push prices towards 53,040.

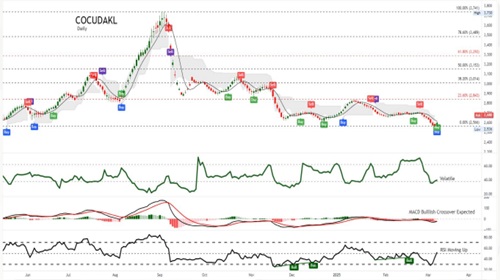

COCUDAKL

BUY COCUDAKL APR @ 2650 SL 2620 TGT 2680-2700. NCDEX

KAPAS

BUY KAPAS APR @ 1445 SL 1435 TGT 1455-1465. NCDEX