Buy IRB Infrastructure Ltd for the Target Rs. 52 by Motilal Oswal Financial Services Ltd

Steady performance; healthy O&M order book and toll collection to drive earnings

* IRB Infrastructure’s (IRB) revenue grew ~8% YoY to INR18.7b during 3Q FY26 (7% above our estimate). Revenue includes: a) Gain on InvITs & Related Assets as per fair value measurement, and b) Dividend/interest income from InvITs & Related Assets.

* EBITDA margins came in at 54.6% (vs our estimate of 53%) in 3QFY26 (+600bp YoY and +180bp QoQ). EBITDA grew ~4% YoY to INR10.2b (10% above our estimate). APAT grew 41% to INR1.4b (in line).

* Construction revenue stood at INR 7.8b (-31% YoY); BOT revenue stood at INR 7.06b (+9% YoY); and InvIT & related assets revenue stood at INR3.8b.

* IRB’s order book stood at INR373b (excl. GST) as of end-Dec’25, of which the O&M order book was INR357b and the EPC order book was INR16b.

* The company declared an interim dividend of INR0.07 per equity share. It also announced a bonus equity share in the ratio of 1:1.

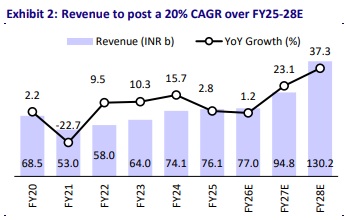

* IRB reported a steady performance, supported by rising toll collections. Marquee under-construction projects, such as the Ganga Expressway, are expected to underpin growth visibility over the medium term. Although EPC order inflows remain subdued at present, the company is strategically focusing on building a sustainable O&M order book, which provides longterm revenue visibility and stable income streams over the next 10–12 years. With recent asset monetization, IRB is now in a far better position to undertake more projects. We largely maintain our estimates for FY26/FY27/FY28. Backed by attractive valuations, a strong order book, and a robust tender pipeline driven by BOT projects, we expect revenue to register a CAGR of 20% over FY25-28. We reiterate our BUY rating with an SoTPbased TP of INR52.

Resilient toll collections; strong order pipeline and recent monetization to help bid for more projects

* In 3QFY26, IRB reported steady operational performance, as EBITDA growth was supported by resilient toll collections and stable contributions from its BOT and InvIT portfolios.

* The order book stood at INR373b as of Dec’25, largely led by O&M (INR357b). Further, asset monetization to the Public InvIT released ~INR49b of capital, enhancing the company’s bidding capacity for the upcoming annual opportunity of ~INR400-500b.

* BOT assets and InvIT investments continued to deliver robust profitability, while construction margins moderated as some projects got completed.

* The private InvIT has won the TOT-18 project worth INR40b, with IRB appointed as the project manager for an estimated consideration of INR15.8b.

Key takeaways from the management commentary

* IRB will not bid for TOT-19, given its new MLF-based tolling model and relatively smaller project size.

* The government asset monetization pipeline remains strong at ~INR3t with an annual opportunity size of INR400-500b. TOT assets remain the primary growth driver.

* Over the next five years, the company aims to improve cash RoE from 8% to 14%+ and deliver a PAT CAGR of ~25%, supported by annuity-led asset base and resilient traffic growth.

* Contribution from O&M revenue is expected to rise, with O&M execution likely to increase to 50% of the order book (from ~25-30% currently).

* Intense competition is being witnessed in HAM projects, and IRB would not participate in those projects in a significant way.

Valuation and view

* The government’s focus on BOT and TOT projects presents significant opportunities. IRB’s strong order book and strategic asset monetization position it well to capture these opportunities. Moreover, NHAI’s tightened RFP norms now emphasize awarding projects to technically and financially strong contractors, thus reducing competition in the industry.

* We largely retain our estimates for FY26/FY27/FY28. Backed by attractive valuations, a strong order book, and a robust tender pipeline driven by BOT and TOT projects, we expect revenue to register a CAGR of 20% over FY25-28. We reiterate our BUY rating with an SoTP-based TP of INR52.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412