Buy ICICI Bank Ltd for the Target Rs.1,750 by Motilal Oswal Financial Services Ltd

Quality seldom comes at a bargain!

Well poised to sustain superior growth and profitability

* ICICI Bank (ICICIBC) has made steady progress in building a resilient, scalable franchise geared up to deliver steady profitable growth. Strengthened tech capabilities and superior underwriting have enhanced the bank’s ability to serve a wider set of customers while keeping strong control over asset quality.

* The bank reported ~11.5% YoY loan growth in 3QFY26 (4% QoQ growth), driven by steady traction in secured retail and BB. Corporate loans also picked up. With an improved outlook in unsecured retail and improving demand visibility, the bank expects the growth momentum to remain steady in the coming quarters.

* ICICIBC’s asset quality remains best-in-class, underpinned by disciplined underwriting, robust monitoring and strong recoveries, while the bank carries a healthy contingency buffer (0.9% of loans). Credit cost is, thus, expected to stay contained, with GNPA/NNPA improving to ~1.4%/0.3% by FY28E.

* The board’s recommendation to extend Mr. Sandeep Bakhshi’s tenure for two years removes a key overhang and reinforces leadership stability This will later allow a planned management transition, thereby ensuring stable performance of the bank and long-term resilience.

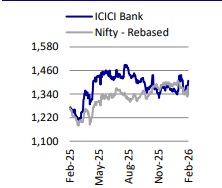

* We estimate ICICIBC to deliver a CAGR of 17.6%/16% in PPoP/PAT over FY26-28, leading to RoA/RoE of 2.3%/16.1% by FY27E. ICICIBC has delivered modest 6% returns in FY26YTD against average 21% returns over FY23/24/25. This has resulted in stock trading at cheaper valuations vs. average trading valuations over past three years. ICICIBC remains our top BUY in the sector with a TP of INR1,750 (premised on 2.7x Sep’27E ABV + INR263 for subs).

Loan growth gaining traction; visible signs of a broad-based recovery

ICICIBC’s credit growth has improved in recent quarters as the bank reported ~11.5% YoY growth in 3QFY26 (4% QoQ). The domestic portfolio expanded at a healthy pace, aided by better traction in secured retail segments and continued strength in BB. Corporate too witnessed healthy traction despite a competitive pricing environment. Management highlighted that demand in the ecosystem has held up well, with early signs of a more broad-based pick-up. The bank remains cautious in unsecured retail, where industry stress pockets have prompted tighter filters and sharper monitoring; however, credit card segment has started showing strong growth. That said, mortgages, CV/CE loans and other secured assets continue to see steady customer activity. With improving sentiment and loan growth picking up, ICICIBC expects to sustain the momentum in 4Q as well. We estimate a 16% CAGR over FY26-28, aided by growth recovery in unsecured retail and corporate segments

Liability franchise robust; estimate ~15% deposit CAGR over FY26-28E

The bank continues to strengthen its liability franchise through diversified acquisition engines, including corporate salary accounts, transaction banking, digital channels and an expanding physical network. While CASA accretion remains challenging industry-wide, ICICIBC focuses on building stability rather than chasing rate-sensitive deposits. Deposit growth in 3Q was 9% YoY, led by improvement in CA balances. The bank’s liquidity position is robust, with LCR comfortably above regulatory thresholds, ensuring flexibility to support upcoming loan growth without compromising the balance sheet. Management reiterated that deposit pricing actions are calibrated to maintain competitive positioning while safeguarding margin stability. In the medium term, strong customer engagement, deep ecosystem partnerships and branch-led sourcing should help the bank sustain double-digit deposit CAGR. We expect deposit growth to be healthy at 15% CAGR over FY26-28E

NIMs stable despite pressure; repricing cycle and repo rate movement to shape near-term trajectory

NIMs have been largely stable in recent quarters, aided by a reduction in the cost of deposits, a steady loan mix, and disciplined pricing across retail and corporate books. Management expects NIMs to remain broadly flat, as the CRR cut and residual TD repricing largely offset the full transmission of the repo rate cut. The impact of the recent repo rate cut is expected to flow through in 4Q, keeping NIMs range-bound. Overall, ICICIBC’s careful loan mix, strong risk filters and disciplined pricing approach should help manage margin pressures effectively in a falling rate environment. We expect NIMs at 4.3% in FY26E and stabilizing at 4.4-4.5% over FY27-28E

Cost leadership to continue; C/I ratio to sustain at ~38-39% over FY27-28E

ICICIBC continues to invest meaningfully in technology, customer delivery, analytics and talent while keeping cost ratios under control. In 3Q, the bank reported an impact of INR1.45b related to the new labor code, which resulted in C/I ratio inching up to 40.8%. The bank expects expense intensity to remain manageable as digital adoption scales further, distribution productivity improves, and operating processes become increasingly simplified. Management reiterated that investments will remain aligned to long-term priorities and calibrated to revenue visibility. While the bank has executed well on cost control, we estimate the C/I ratio to stabilize at 38-39% over FY27-28E.

Leadership overhang addressed; planned transition to ensure operating continuity

ICICIBC board has recommended a further two-year term for Mr. Bakhshi to the RBI, which has addressed a key overhang for the stock. Under Mr. Bakhshi's leadership, the bank has undergone a radical transformation, shifting emphasis from individual to team performance. This strategic shift has enabled the bank to consistently deliver stronger outcomes, thus moving away from a culture that previously incentivized individual stardom. The ‘One Bank, One team’ approach has encouraged employees to collectively work toward the greater organizational goals, thus helping achieve superior results. The bank’s strong focus on core PPoP growth while fostering a cohesive organizational culture underpins its position as a resilient and successful institution. The bank distinguishes itself with a strong leadership bench and a commitment to structured processes, which will enable continued delivery over the long term.

Asset quality robust; credit cost to sustain at 45-50bp over FY27-28E

The bank’s asset quality remains among the best in the industry, supported by strong underwriting, due diligence and adherence to processes and healthy recoveries, backed by robust monitoring systems. Provision buffer remains strong, with contingency reserves of INR131b (0.9% of loans), providing adequate insulation against macro stress. During 3Q, the bank created INR12.8b of provisions as certain agricultural exposures (estimated at INR200-250b) were identified as not fully compliant with PSL norms; however, management expects credit costs to remain under control. Overall, we estimate GNPA/NNPA to further improve to ~1.4%/0.3% by FY28E and credit cost to remain at 45-50bp over FY27- 28E.

Valuation and view: Reiterate Buy with TP of INR1,750

ICICIBC has entered a phase where its operating variables exhibit far less volatility and the bank appears well poised to sustain this leadership over coming years. The bank remains firmly on track to deliver RoA of ~2.2% in FY26E (despite one-off provisions in 3Q) and RoE of ~16% over FY26-27. The bank’s approach is measured and deliberate, avoiding aggressive expansion while capturing market share in segments where risk-adjusted returns are favorable. With the expansion of Mr. Bakhshi’s term, the bank is well positioned to continue its journey of delivering best-in-class growth and profitability and remains one of the most dependable large-bank stories in the sector. We thus estimate ICICI Bank to deliver a CAGR of 17.6%/16% in PPoP/PAT over FY26-28E, leading to RoA/RoE of 2.3%/16.1% by FY27E. ICICIBC remains our top BUY in the sector with a TP of INR1,750 (premised on 2.7x Sep’27E ABV + INR263 for subs

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412