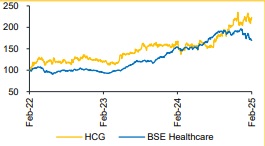

Buy Healthcare Global Enterprises For the Target Rs. INR 621 By the Choice Broking Ltd

Revenue above our estimates, while EBITDA/PAT below estimates

Revenue came at INR 5.6 Bn (vs. CEBPL est. of INR 5.4 Bn), up 18.9% YoY and flat QoQ. ? ARPOB at INR 44,284, up 3.5% YoY and down 2% QoQ, while occupancy improved to 62.1% from 59.8% in Q3FY24. ? EBITDA came at INR 0.9 Bn (vs. CEBPL est. of INR 1.0 Bn), up 12.4% YoY and down 13.6% QoQ. EBITDA margin came at 15.8% (vs. CEBPL est. of 18.5%), contracted by 91bps YoY and 265bps QoQ. ? PAT came at INR 0.1 Bn (vs. CEBPL est. of INR 0.2 Bn), up 22.5% YoY and down 61.2% QoQ, with a PAT margin of 1.2% (same as Q3FY24).

Growth to be driven by ~900-bed expansion, international patient recovery

HCG's growth over the next 2-3 years is expected to be driven by a combination of organic expansion, brownfield projects, and acquisitions. The company plans to add approximately 900 beds, increasing operational capacity from 2,154 beds in Q3FY25 to 2,800 beds by FY27. To maximize the potential of its existing centers, HCG is likely to expand in high-demand markets like Bengaluru. Additionally, the international patient segment, contributing 3.5-4% of total revenue, has been impacted by geopolitical challenges, particularly in Bangladesh, but is expected to recover starting from Q4FY25.

EBITDA margins to reach 21% by FY27E under KKR's management

HCG has experienced a temporary dip in EBITDA margins due to lower operating leverage. However, with KKR set to acquire a 54% stake, we anticipate HCG will benefit from operational enhancements under new management. KKR’s proven expertise in healthcare investments will play a crucial role in this transition. Furthermore, as the company realigns its revenue streams, we expect EBITDA margins to improve significantly, rising from 17% in FY25E to 21% in FY27E.

For Investors Information:

The Milan IVF centers (five in Bengaluru and one in Chandigarh) have faced challenges due to competition from their former founder. Management anticipates a recovery starting in FY26; however, their revenue contribution is expected to remain below 5% (currently below 2%).

View and Valuation:

We expect Revenue and EBITDA to grow at a CAGR of 19% and 28%, respectively, from FY24-27E, driven by revenue realignment (focus on high margin oncology treatments), operational expertise from KKR’s stake acquisition, and the rising importance of oncology in India’s healthcare market. EBITDA margins are expected to improve by 150 bps annually. Additionally, the planned addition of ~900 beds over the next three years will serve as a key growth driver. We value the company at 15x EV/EBITDA on FY27 estimates, arriving at a target price of INR 621, and maintain a BUY rating on the stock.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131