Buy Happy Forgings Ltd for the Target Rs. 984 by Motilal Oswal Financial Services Ltd

Richer mix drives margin expansion despite weak demand

PV and Industrials to be key growth drivers

* Happy Forgings’ (HFL) 4QFY25 PAT of INR678m was in line with our estimate. In FY25, HFL generated FCF of INR119m post capex of INR2.8b.

* A recovery in domestic CV demand, healthy tractor outlook and strong order wins in Industrials and PVs should help to offset the weakness in CV and tractor exports in the near term.

* We expect HFL to post a CAGR of 14%/16%/16% in revenue/EBITDA/PAT during FY25-27E. After the recent correction, the stock at 25.9x FY26E and at 21.7x FY27E appears attractively valued. We reiterate our BUY rating on the stock with a TP of INR984 (based on 26x FY27E EPS).

Margins improve in a weak demand environment driven by richer mix

* 4Q PAT of INR 678m was in line with our estimate.

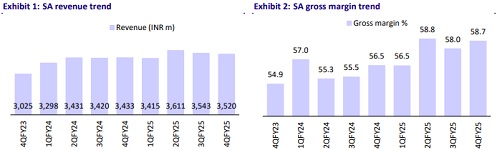

* Revenue grew 2.5% YoY to INR2.5b. Revenue growth was driven by strong momentum in the industrials, off-highway and farm segments, which was offset by weakness in domestic CV demand and exports.

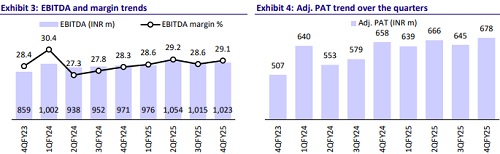

* EBITDA margins improved 80bp YoY to 29.1%, led by an improving mix.

* PAT grew 3% YoY to INR678m.

* FY25 revenue grew 4% YoY to INR14.1b.

* While domestic growth was 6% YoY, direct exports remained flat YoY. As a result, export contribution marginally declined to about 18% of revenue. Of this, CVs contribute about 12% and the balance comes from industrials.

* Led by an improved mix, ASP improved to INR248 per kg in FY25, despite the INR7-8 per kg decline in steel prices.

* For FY25, the machining mix improved to 87% from 85% YoY.

* EBITDA margin expanded 40bp YoY to 28.9%.

* PAT grew 10% YoY to INR2.7b.

* For FY25, cash and cash equivalents stood at INR3.6b, with D/E comfortable at 0.1x.

* HFL generated FCF of INR119m post capex of INR2.8b in FY25.

* The board has recommended a dividend of INR3 per share, which translates into 11% dividend payout.

Highlights from the management interaction

* Medium-term guidance: HFL has been growing at the 15-18% rate organically for the last few years, and it aims to sustain this run rate over the medium term on the back of its healthy order backlog.

* CV business outlook: While the domestic MHCV industry is expected to post growth in FY26, global CV sales are likely to decline in high single digits in CY25 given weakness in the US Class8 segment. HFL is likely to continue to outperform industry growth on the back of its new order wins from large domestic CV players.

* Tractor business outlook: The domestic tractor industry is expected to post high-single-digit growth in volumes in FY26. However, HFL expects tractor exports to start recovering from 3QFY26. Stock liquidation has already happened from dealers; hence, management expects a recovery by 2HCY25.

* Industrials + PV outlook: Order wins between PV and industrial stand at INR16b to be executed over the next 5-8 years, with annual peak revenue of INR2.5b. The PV + industrial contribution will then rise to 25% of total revenue.

* Update on capex: HFL would invest INR4b in FY26, including INR800m for PVs.

Valuation and view

* HFL is expected to outperform the industry, driven by new client additions, product expansion, and capacity growth. A recovery in domestic CV demand, a healthy tractor outlook and strong order wins in industrials and PVs should help to offset the weakness in CV and tractor export markets in the near term.

* We expect HFL to deliver a CAGR of 14%/16%/16% in standalone revenue/EBITDA/PAT during FY25-27E. HFL’s superior financial track record compared to its peers serves as a testament to its inherent operational efficiencies and is likely to be a key competitive advantage going forward. After the recent correction, the stock at 25.9x FY26E and at 21.7x FY27E appears attractively valued. We reiterate our BUY rating on the stock with a TP of INR984 (based on 26x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)