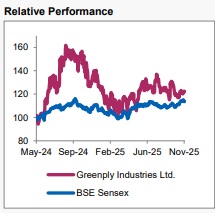

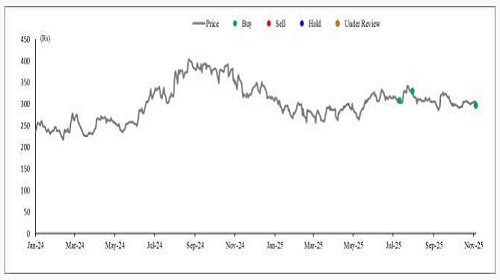

Buy Greenply Industries Ltd For the Target Rs.385 by Axis Securities Ltd

Steady Growth; Margin Recovery Expected

Est. Vs. Actual for Q2FY26: Revenue - INLINE; EBITDA (Adj.) - MISS; PAT - MISS

Changes in Estimates Post Q2FY26 Result

FY26E/FY27E: Revenue: 3%/2%; EBITDA (Adj.): 3%/2%; PAT : 4%/2%

Recommendation Rationale

* Operating Leverage from MDF Capacity Expansion: The MDF business continues to be an important growth driver for Greenply. The company has increased its capacity from 800 to 1,000 CBM per day, and the plant is now running at higher utilisation levels. Management is focusing on using the plant more efficiently, reducing costs, and selling more industrialgrade MDF, which offers better margins. With fewer imports and strong demand in the domestic market, pricing conditions have also improved. As production and sales volumes increase, fixed costs will be spread over more units, helping to improve margins and profitability in the coming quarters.

* Structural Growth in Organised Sector: Greenply stands to benefit from the accelerating shift towards branded players, driven by BIS enforcement and a crackdown on unorganised trade. The company’s dual-brand strategy — “Green” in premium and “Ecotec” in value — enables it to tap into multiple price segments. With stable raw material prices, operational efficiency, and volume-led growth, margins are poised to expand. Rising penetration of modular furniture and urban housing recovery further support long-term demand visibility.

* Margin Recovery Ahead: Greenply reported Q2FY26 revenue of Rs 689 Cr, up 7.5% YoY, with EBITDA at Rs 57 Cr (margin 8.2%). While margins were temporarily impacted by oneoffs in MDF (liquidation at discounts) and a lower product mix in plywood, management expects a strong H2 recovery, guided H2 plywood margins near 10%, MDF margins above 16%, and steady volume growth above 10%. Overall FY26 margin guidance are at ~8.5% for plywood and the company expects full capacity utilisation for MDF by H2FY26 with ~15% margins. With improving utilisation and working capital reduction, EBITDA margins and cash flows are likely to improve meaningfully in H2FY26, setting up a better earnings trajectory into FY27.

Sector Outlook: Positive

Company Outlook & Guidance: Management expects business performance to improve in H2FY26. Demand for plywood should rise as housing activity picks up and the new BIS rules continue to support organised players. The company is targeting more than 10% growth in plywood volumes and margins close to 10% in the coming quarters. The MDF business is also expected to do better with full use of the 1,000 CBM per day capacity, helping margins move above 16% in the second half and around 14.5–15% for the full year. Greenply also plans to improve working capital and reduce debt through better collections and inventory management. Overall, it expects stronger margins, higher cash flows, and better profitability in the second half of FY26.

Current Valuation: 23X FY28E EPS (Earlier 25X FY27E EPS)

Current TP: Rs 385/share (Earlier TP: Rs 385/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

Greenply reported revenue of Rs 689 Cr, up 7.5% YoY, which is in line with our estimates. The overall demand scenario in the industry saw recovery for the first two months of the quarter. Gross margins were down by 525 bps YoY. The reported EBITDA stood at Rs 57 Cr, showing de-growth of 1.5% YoY, with a lower EBITDA margin of 8%. The company reported PAT of Rs 16 Cr, down 9% YoY. During the year, its MDF volumes saw growth of 16% YoY, whereas the plywood business saw a 7% YoY growth. Segment revenue for the Plywood business stood at Rs 542 Cr, up 5%YoY, and for the MDF business stood at Rs 147 Cr, which was flat YoY.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633