Buy Granules India Ltd for the Target Rs. 640 by Choice Broking Ltd

Business Overview:

GRAN India is a vertically integrated pharmaceutical company engaged in the development, manufacturing, and marketing of APIs, pharmaceutical formulation intermediates and finished dosages (FD) across more than 80 countries. Headquartered in Hyderabad, the company operates eight manufacturing facilities in India and two in the US, with global accreditations from US FDA, EU GMP, TGA and WHO GMP. Its product portfolio is anchored by high-volume APIs such as paracetamol, ibuprofen, and metformin, supported by one of the world’s largest PFI/FD plants at Gagillapur. With strong R&D capabilities in Hyderabad and Pune, Granules is expanding into complex generics and specialty segments, including peptides through its acquisition of Senn Chemicals, while also building a growing presence in CDMO services.

Can GRAN’s facility clearances unlock the next leg of growth?

GRAN’s Gagillapur plant, under remediation since August 2024, is on track for FDA clearance by December 2025. A full status report was submitted in July with no concerns raised, and the site is eligible for re-inspection in September 2025. Post-clearance, management aims to commercialize pending approvals, positioning the company for a strong recovery from FY27E. In parallel, the Genome Valley facility, which recently completed its first FDA inspection with only one procedural observation, adds 10 Bn doses of capacity and provides a second source of US supply—enhancing scalability and mitigating tariff-related risks.

Is GRAN positioned to capture the next wave of specialty and peptide opportunities?

In FD, GRAN has a strong pipeline with six launch-ready products in Europe and multiple large-volume Rx launches in the US, including several first-to-file (FTF) opportunities led by CNS therapies. This should support sustained double-digit growth. Meanwhile, the CDMO/Peptides division, bolstered by the Senn Chemicals acquisition, is beginning to contribute meaningfully. With a dedicated R&D center slated for October 2025 and a commercial-scale peptide facility by FY27, the company is wellpositioned to scale high-value therapies, including GLP-1 and oncology products. While the US remains a key market, Granules is expected to prioritize Europe, leveraging its Switzerland plant as front-end and India as a CDMO hub.

Why Invest in GRAN?

GRAN is well-positioned for sustainable growth driven by strong execution and strategic investments:

* Strategic Capacity Addition: GRAN is set for a comeback in FY26E, supported by the commencement of production at its Genome Valley facility, which adds ~40% new capacity alongside multiple product approvals.

* Peptide-CDMO Foray: The acquisition of Senn Chemicals provides GRAN a strong entry into the CDMO and peptides space, expected to become a meaningful revenue contributor in the coming years.

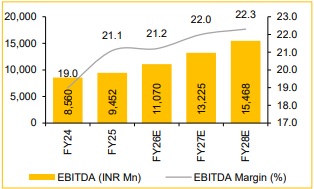

* Margin Expansion: The Genome Valley scale-up will enhance operating leverage, with EBITDA margin expansion of ~100bps anticipated as utilization ramps up.

Recommendation: We currently have a ‘BUY’ rating on the stock with a target price of INR 640.

Key Risks:

* Regulatory and Compliance Risks: Delays or adverse outcomes in regulatory approvals, especially in the US, could impact product launches and revenue visibility.

* Rising Promotional Spend: Continued expansion of the field force and promotional intensity may pressure EBITDA margins if revenue growth lags expectations.

* US Generic Pricing Pressure: Sustained price erosion and competitive intensity in the US generics market could offset gains from new launches.

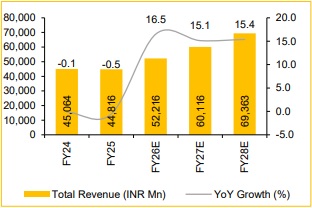

Revenue to Expand by 15.7% CAGR (FY25-28E)

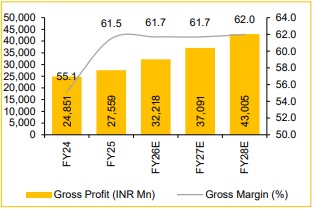

Gross Margins to Remain at FY25 Levels???????

EBITDA Margins to Improve by 121bps by FY28E???????

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131