Buy Go Fashion Ltd For Target Rs. 980 By JM Financial Services

Delayed recovery on sustained demand pressure

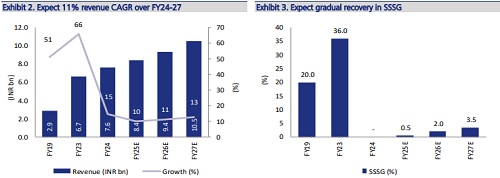

We recently met with the management of Go Fashion, which highlighted that the recent impact on overall revenue growth was due to demand slowdown and not due to concerns relating to product portfolio/ASP, and that the company continued to outperform its peers. The recent slowdown has impacted new customer addition, hitting volume/EBO. EBO consolidation, which was the pain point in FY25, will be largely over by Mar’25. The company expects to add ~120 stores annually over the next 2-3 years. Strategic initiatives in the MBO business and improved performance in the LFS business will also aid the company in its long-term growth trajectory. We cut our target price to INR 980 from INR 1,160, as delay in demand recovery is resulting in a cut in our FY26-27 Revenue/PAT estimates by 2-5%/5- 7%, coupled with a cut in our target multiple to 38x from 42x earlier on account of (i) muted Revenue/PAT CAGR of 11%/12% over FY24-27 vs. 22%/20% CAGR over FY19-24, (ii) dilution in RoE/RoCE to 16%/13% in FY27, and (iii) increase in promoter pledge from 17.4% to 19.8% due to fall in share prices. We maintain BUY as the recent stock price correction of ~30% in 3 months has rendered the risk reward ratio favourable

* Weak demand environment in 4Q: The management highlighted that the overall demand environment remained soft in 4QFY25. The slowdown is largely market-driven and not specific to the company. While demand in Jan’25 and Feb’25 was in line with expectations, there was some deceleration in demand in Mar’25. Repeat purchases have been stable, but new customer acquisition has been challenging for the company in this tough demand environment, which is impacting SSSG growth and resulting in a decline in volume per EBO (refer exhibit - 6). The management remains confident on the product portfolio and doesn’t believe that its relative price premium has increased vs. peers. The demand impact is higher for other women-wear centric brands vs. Go Fashion. Increase in ASP is mainly due to improved product mix rather than price hike. Leggings now contribute only 30% of overall revenue vs. 50% earlier.

* Channel strategy: EBO – Store consolidation is expected to be largely complete by Mar’25. The company aims to add ~120 stores annually over the next 2-3 years. It will expand in a manner that doesn’t lead to cannibalisation of existing stores. The store concentration in eastern and northern region is lower at ~25% due to (1) higher rentals, and (2) higher preference for lower-ASP products. Hence, the company is expanding in these regions in a calibrated manner. The LFS business is now stabilising. LFS addition will be largely led by deepening penetration of existing players and very little addition from new LFS partners. The management expects addition of 100+ LFS doors every year. The Multi-Brand Outlet (MBO) business currently contributes less than 0.5% of total revenue. In Oct’24, the company appointed Mr Vijay Srinivas as head of the MBO business. He has a prior experience in FMCG and general trade segments. Over the next 3-4 years, Go Fashion aims to gradually increase the MBO channel’s revenue contribution to 3-4%.

* Margins: Margin in FY25 was largely impacted due to lower throughput and higher rentals. The company expects to achieve 62-63% gross margin and EBITDA margin of 17.5-18% (including other income) in FY25. It aims to maintain gross margin at similar levels and expand EBITDA margin by ~100bps in FY26, led by better operating leverage.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)

2.jpg)