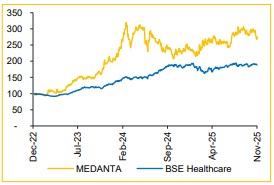

Buy Global Health Ltd For Target Rs. 1,350 By Choice Broking Ltd

Expansion-led Growth with Strong Earnings Visibility: MEDANTA is entering a strong growth phase, targeting the addition of over 3,000 beds in Noida, Mumbai and Guwahati over the next three years. Supported by robust performance from existing hospitals, the company is well-positioned to sustain a 15–20% revenue CAGR in the coming years. On the strength of strong strategic locations, this expansion will unlock significant long-term value.

View and Valuation: We forecast Revenue/EBITDA/PAT to expand at a CAGR of 16.5%/18.1%/24.9% over FY25–FY28E. Valuing the stock at an EV/EBITDA multiple of 27x (maintained) on the average of FY27 and FY28 estimate, we arrive at a revised target price of INR 1,350, maintaining our ADD rating.

Strong Revenue Growth, Margin Pressure Persists

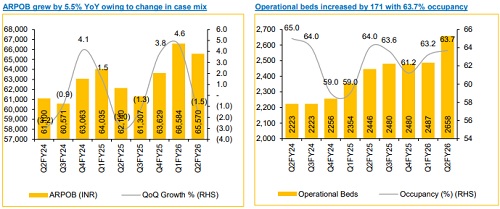

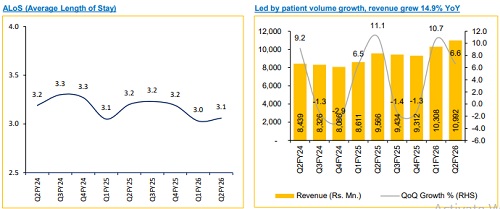

* Revenue grew 14.9% YoY / 6.6% QoQ to INR 11Bn (vs. CIE estimate: INR 11.4 Bn)

* EBITDA grew 1.1% YoY / 1.7% QoQ to INR 2.3 Bn (vs. CIE estimate: INR 2.7 Bn); margin contracted by 286 bps YoY / 101 bps QoQ to 21.0% (vs. CIE estimate: 23.8%)

* PAT increased by 21% YoY and flat on QoQ to INR 1.6 Bn (vs. CIE estimate: INR 1.7 Bn)

Strategic Multi-City Expansion to Power MEDANTA’s Next Growth Wave

MEDANTA is pursuing a well-calibrated expansion plan that will significantly boost capacity and regional presence. The newly-launched 550-bed Noida hospital strengthens its NCR leadership, while the upcoming over 400-bed Guwahati facility extends reach into the underserved Northeast. The Mumbai Oshiwara project, now scaled up to 750 beds, marks its entry into Western India’s premium market. Complementing these are new developments in South Delhi and Pitampura and continued enhancements in Ranchi, Lucknow and Patna. We believe that MEDANTA’s pipeline of large, strategically-placed hospitals positions it for strong 15–20% top-line CAGR in the next few years.

Balanced Growth across Mature and Developing Facilities

MEDANTA’s performance showcases a balanced growth model between its mature hospitals (Gurugram, Indore, Ranchi) and developing facilities (Lucknow, Patna, Noida). Mature units delivered strong occupancy (~61%) and 10% ARPOB growth, reflecting higher case complexity and brand trust. Meanwhile, developing hospitals posted 28% revenue and 34% EBITDA growth, with 70% occupancy and over 30% margin. Lucknow and Patna have emerged as high-performing centers, validating MEDANTA’s ability to replicate success across regions through superior clinical quality and cost-efficiency.

We believe that this dual-engine strategy, stability from mature centers and rapid scaling up from developing ones, ensures consistent growth, margin resilience and predictable cash flows. As Noida ramps up and Lucknow transitions into a mature unit, MEDANTA is set to deliver sustained earnings expansion with strong operating leverage across its network.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 00016013