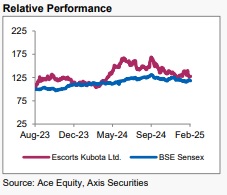

Hold Escorts Kubota Ltd For the Target Rs. 3,420 By the Axis Securites

Recommendation Rationale

Agri-Business Outlook in India: In Q3FY25, Escort's tractor segment experienced a 6% YoY growth in domestic volumes (vs 13.5% tractor industry); Segment revenue was up 9.4% YoY, led by price hikes taken during the year. Exports for Escorts were down 29.2% YoY, compared to industry growth of 3.9% YoY. The domestic slowdown witnessed in 9MFY25 is expected to be followed by a moderate recovery in Q4FY25 and beyond, driven by pent-up demand, government assistance, higher reservoir levels, and better crop realisation by the farming community.

Construction Equipment (CE) Business: Q3FY25 witnessed a 0.9% YoY volume decline (but up 42.7% QoQ), and segmental revenue was up 4% YoY to Rs 516 Cr. This volume decline was mainly due to lower government spending on infra projects (on account of union elections), followed by heavy monsoons. We expect a gradual pickup in infrastructure activities from Q4FY25 onwards.

New launches to fill gaps in Product portfolio: With a strategy to offer innovative products, Escorts has launched the PROMAXX series under the Farmtrac brand in the 30 to 50 HP category. The company has ~1540 exclusive dealers for Kubota, Farmtrac, and Powertrac combined. The series is primarily for the western markets—Gujarat, Maharashtra, and certain markets where Escorts is not present—Chhattisgarh, Odisha, and some parts of MP.

Sector Outlook: Positive

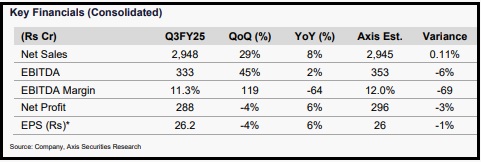

Company Outlook & Guidance: The domestic tractor industry and construction equipment business are expected to pick up gradually in the medium term. On account of the amalgamation of two subsidiaries (having poor operational metrics), we expect EBITDA margins to remain subdued in the near term (<12%).

Current Valuation: 28x FY27E EPS (unchanged)

Current TP: Rs 3,420/share (Earlier TP: Rs 3,290/share)

Recommendation: We maintain our HOLD rating on the stock.

Financial Performance: Escorts Kubota Ltd. (Escorts) reported revenue of Rs 2,948 Cr (inline), up 8.1% YoY and 29.5% QoQ in Q3FY25. EBITDA stood at Rs 333 Cr (5.6% miss), up 2.2% YoY and 44.7% QoQ, with EBITDA margins at 11.3%, down 64 bps YoY but up ~119 bps QoQ, primarily due to production swings in Q3, higher raw material costs, and discounting. The company reported an adjusted PAT of ~Rs 288 Cr (2.6% miss), down 4% YoY and 2.6% QoQ, largely in line with EBITDA performance.

Outlook We expect (1) The industry to witness high single-digit growth in FY26; (2) Infrastructure spending to improve gradually in the medium term and hence boost demand in the CE division; and (3) With expected stability in commodity prices and a richer product mix (growth in export sales), EBITDA margins are expected to remain resilient in the long run.

Valuation & Recommendation In the backdrop of the company’s positive long-term fundamentals – strong cash flow generating capabilities and greenfield expansion projects – we value the stock at 28x FY27 EPS (unchanged). However, synergy benefits with Kubota in agribusiness are expected to take longer than estimated earlier due to a slowdown in international markets. Additionally, discontinuing profits from RED in FY25/26 onwards (we revise our FY25/26E earnings downward), the valuation appears full. Hence, we maintain our HOLD rating on the stock with a TP of Rs 3,420 (earlier Rs 3,290), implying a limited upside of ~3% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633