Buy Biocon Ltd For Target Rs.420 by Motilal Oswal Financial Services Ltd

Execution in Biologics/Syngene drives operational performance

Compliance provides better visibility for niche approval/launches

* Biocon (BIOS) delivered a better-than-expected operational performance in 3QFY25. However, earnings came in below our estimate due to a higher tax outgo. BIOS has been witnessing improved traction in the biologics segment on the back of steady market share gains and its increasing reach in new geographies. After three quarters of YoY revenue declines, Syngene delivered YoY sales growth in 3QFY25, led by better traction in research, CMO and biologics segments.

* While we maintain our sales/EBITDA estimates, we reduce our earnings estimates by 13%/4% for FY26/FY27, factoring in a higher tax rate. We value BIOS on SOTP basis (22x 12M forward EV/EBITDA for 73% stake in Biocon Biologics, 53% stake in Syngene and 14x EV/EBITDA for generics business) to arrive at a TP of INR420.

* With USFDA GMP compliance at Biocon park and Malaysia facility and bStellara approval, we expect the company’s sales trajectory to strengthen going forward. In fact, the regulatory compliance provides better visibility for Insulin Aspart approval as well, which would be another niche opportunity for BIOS in FY26. We expect Syngene to also deliver better growth in FY25-27 compared to FY23-25 on the back of demand tailwinds and Syngene’s capability/capacity. Further, BIOS is implementing efforts in the peptide space within the generics segment, with commercial benefits expected FY26 onward. Maintain BUY.

Operating leverage outweighs higher RM costs

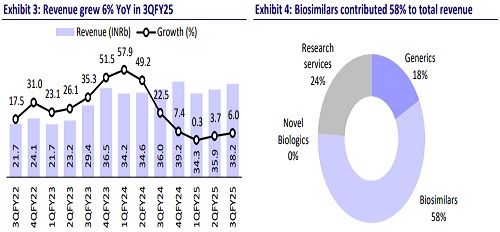

* 3QFY25 revenue grew 6% YoY to INR38.2b (est. INR37.1b). Research services (24% of sales) grew 11% YoY to INR9.4b. Biosimilars (58% of sales) declined 8% YoY to INR2.3b. Generics sales declined 2% YoY to INR6.9b.

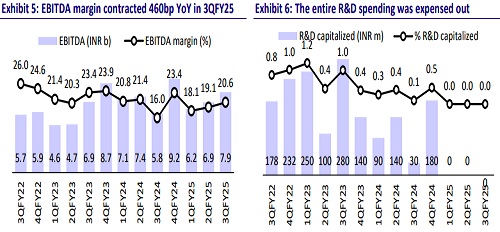

* Gross margin (GM) contracted 140bp YoY to 62%. ? EBITDA margin expanded 370bp YoY to 19.7% (est. 19.5%), as lower R&D/other expenses (-390bp/-490bp YoY as % of sales) were offset by higher employee costs (+370bp YoY as % of sales).

* EBITDA grew 30.3% YoY to INR7.5b (est. INR7.2b).

* After adjusting a one-off expense of INR163m and a one-time tax outgo of INR95m for SYNG, BIOS reported PAT of INR339m vs. a loss of INR1.7b in 3QFY24 (est. PAT: INR715m).

* During 9MFY25, revenue/EBITDA grew 3%/1% YoY to INR108b/INR20.6b. BIOS reported an adj. loss of INR900m in 9MFY25 vs. a profit of INR742m last year.

Highlights from the management commentary

* BIOS maintains growth outlook for 2HFY25 and FY26 at the group level.

* BIOS expects to sustain EBITDA margin at 22-23% over the next 18-24 months at BBL level.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412