Upgrade to Buy Punjab National Bank Ltd For Target Rs.125 by Motilal Oswal Financial Services Ltd

Strong quarter; asset quality continues to improve

Business growth remains healthy

* Punjab National Bank (PNB) reported a healthy 3QFY25 PAT of INR45.1b (103% YoY growth, 24% beat), primarily driven by provisioning reversal.

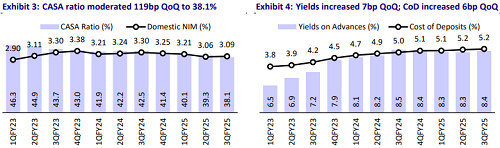

* NII grew 7% YoY/5% QoQ to INR110.3b (in line), while NIM inched up 1bp QoQ to 2.93% (3.09% domestic NIMs).

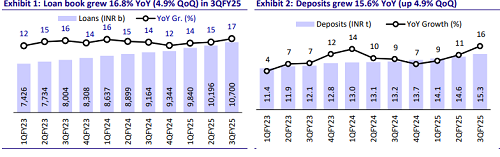

* Loan book grew 16.8% YoY (4.9% QoQ) to INR10.7t, led by continued traction in retail loans, up 22.6% YoY/5.0% QoQ. Deposits grew 15.6% YoY/4.9% QoQ. As a result, the C/D ratio was broadly stable at 70%.

* Slippages declined to INR17.7b vs INR21.8b in 2QFY25. GNPA/NNPA ratios moderated by 39bp/5bp to 4.09%/0.41%. PCR ratio was stable at 90.2%.

* We raise our EPS estimates by 9.4%/9.2% for FY26/FY27, factoring in a sharp reduction in provisions. We estimate RoA/RoE at 1.0%/14.9% in FY27. We upgrade PNB to BUY given its comfortable CD ratio, strong provision reversal potential, and a healthy recovery pipeline, which should support earnings. NIMs have an upside bias on the back of improving asset yields, PNB’s potential to grow faster than the system, and strong cost control. With a steady RoA outlook and margin tailwinds, we see a favorable riskreward. Our TP of INR125 is based on 1.0x Sep’26E ABV.

Margins broadly stable; C/D ratio comfortable at ~70%

* PNB reported a PAT of INR45.1b (103% YoY growth, 24% beat), primarily driven by provision reversal. In 9MFY25, PAT stood at INR121b (130% YoY). 4QFY25 PAT is expected at INR46.5b (54% YoY).

* NII grew 7% YoY/5% QoQ to INR110.3b (in line), while NIMs inched up 1bp QoQ to 2.93%. Other income increased 28% YoY to INR34.1b (in line). Total revenue thus grew 11% YoY to INR144.4b (in line).

* Opex increased 18% YoY to INR78.23b (3% higher than MOFSLe). As a result, the C/I ratio moderated to 54.2% (vs. 54.6% in 2Q). PPoP thus grew 5% YoY to INR66.2b (in line).

* Loan book grew 16.8% YoY (4.9% QoQ) to INR10.7t amid healthy traction in retail, agri and MSME. PNB expects healthy traction in credit growth at 13- 14% in 4QFY25, led by the RAM segment.

* Deposits grew 15.6% YoY/4.9% QoQ to INR15.3t, led by healthy traction in TDs at 6.2% QoQ. The CASA ratio, thus, moderated to 38.1% from 39.3% in 2QFY25.

* On the asset quality front, slippages declined to INR17.7b from INR21.8b in 2QFY25. GNPA/NNPA ratios moderated by 39bp/5bp to 4.09%/0.41%. The PCR ratio was stable at 90.2%.

* SMA-2 (above INR50m) moderated to 0.14% of loans from 0.20% in 2QFY

Highlights from the management commentary

* NPA recovery contribution to interest income was INR 6.45b (from GLP and TWO pool) vs. INR 6.06b in the previous quarter. The bank expects a similar recovery run rate to continue.

* PNB expects total recovery of INR50-60b in 4Q. The bank has guided for a fullyear FY25 recovery of INR180b (~INR115b for 9MFY25).

* AS-15 provisions: With a 30bp decline in the yield, the bank recalculated its provisioning requirement, which led to high provisioning in Sept’24 (INR54b for FY25). In 3Q, these provisions amounted to INR14b and the bank expects them to remain at a similar level in 4QFY25.

Valuation and view: Upgrade to BUY with a TP of INR125

* PNB reported a healthy quarter, characterized by robust business growth, stable margins and continued improvement in asset quality. NII was largely flat QoQ, while NIMs remained broadly stable. Business growth was healthy, with management aiming to increase the mix of RAM portfolio, which should result in steady margins. Asset quality continues to improve, with slippages declining further on a sequential basis. SMA overdue (with loans over INR50m) too saw improvement to 0.14% of domestic loans.

* We raise our EPS estimates by 9.4%/9.2% for FY26/FY27, factoring in a sharp reduction in provisions. We estimate RoA/RoE at 1.0%/14.9% in FY27. We upgrade PNB to BUY given its comfortable CD ratio, strong provision reversal potential, and a healthy recovery pipeline, which should support earnings. NIMs have an upside bias on the back of improving asset yields, PNB’s potential to grow faster than the system, and strong cost control. With a steady RoA outlook and margin tailwinds, we see a favorable risk-reward. Our TP of INR125 is based on 1.0x Sep’26E ABV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412