Banking Sector Update : Repo cut to hurt NIMs; other measures seem bank positive by Emkay Global Financial Services Ltd

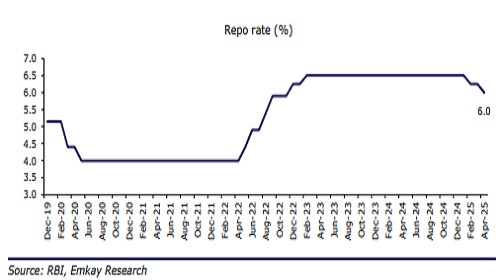

In its Apr-25 monetary policy review, RBI cut repo rate further by 25bps to 6%, and changed policy stance to ‘Accommodative’ from ‘neutral’. This raises hopes for more rate cuts, albeit contingent on evolving macro-economic dynamics amid ongoing tariff wars. Separately, RBI released guidelines to allow stressed asset securitization, expanded co-lending arrangement between banks and even for non-PSL category, partial credit enhancement (PCE) by regulated entities to support the corporate bond market, and aligned gold loan directives between banks-NBFCs to reduce arbitrage and arrest aggressive practices.

Swift and consecutive repo rate cuts to hurt bank margins

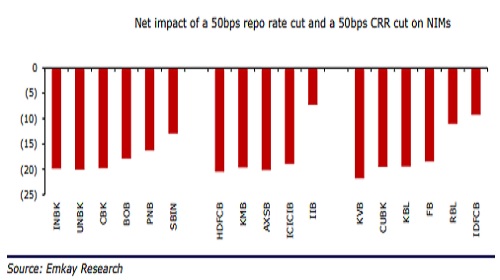

After a 25bps cut in Feb-25, the RBI unanimously cut repo rate by another 25bps and has also changed policy stance to Accommodative from neutral, thereby leaving scope for more cuts during the year (25-50bps). We believe that consecutive and swift rate cuts vs the earlier expected shallow rate cycle could accelerate pressure on margins for banks with higher share of floating rate (EBLR) loans, as deposit re-pricing (downward) could happen with a lag. We believe that the cumulative impact of a 50bps repo rate cut, partly offset by a CRR cut, could be 7-20bps on margins, without factoring in any immediate deposit rate cut. However, we believe that a few banks like IIB, IDFCB, and RBL will be relatively less impacted (under-11bps), given relatively higher share of fix rate loans. On the other hand, MFI and Card heavy NBFCs like CREDAG and SBI Cards should be net beneficiaries.

Gold loan guidelines to reduce arbitrage between banks-NBFCs and arrest aggressive practices

The RBI has directed all regulated entities (REs) to institute robust systems for monitoring end-use of loans, mandating documentary evidence for all loans above a lender-defined threshold. RBI re-emphasized that loan to value (LTV) cap of 75% needs to be maintained through the loan tenure rather than only at the time of disbursement, which reportedly was not diligently followed by a few non-bank players. Further, the RBI has clarified that top-ups or renewals of bullet loans can now be permitted upon repayment of only the accrued interest, rather than the earlier requirement of repaying both, principal and interest—a relaxation that is favorable for all REs (more so for banks). Further, a transparent auction mechanism must be put in place, with a reserve price of at least 90% of the current gold value, linked to market rates. We believe these measures collectively address several existing grey areas and are expected to enhance transparency and reduce customer grievances.

RBI explicitly allows bank-to-bank co-lending arrangement and extends scope beyond priority sector loans (PSLs)

Currently, most co-lending arrangements are between banks and NBFCs, but the RBI has now explicitly allowed such arrangements between all REs (excluding SFBs, LABs, and RRBs) and expanded the scope beyond PSL. Though the RBI in the recent past has been closely scrutinizing co-lending arrangements between banks and NBFCs putting business under this model on the slow road, we believe such guidelines as well as the new governor’s press statement have re-invigorated hopes of current lending partners and open the gates for more such arrangements. The RBI has emphasized on uniform asset recognition practice across co-lenders at the borrower level, ie if any of the REs classify their exposure as SMA/NPA, the same classification shall be applicable to other REs too.

REs allowed to securitize stressed assets; positive for corporate heavy banks

In addition to the existing ARC route under the SARFAESI Act, REs shall now be allowed to securitize their stressed assets (which is already allowed for standard assets), through market-based mechanism barring a few loans like farm credit, education loan, etc. However, they can sell loans to SPV only on cash basis and the loans can be de-recognized from books only upon receipt of an entire sale consideration. Further, the originator RE’s exposure limit shall be capped at 20% of total securitization exposure, with any exposure over-10% treated as first loss. Overall, we believe this initiative shall help corporate heavy banks, including large PVBs and PSBs, in timely realization of stressed assets and enhance balance sheet liquidity.

Partial credit enhancement to provide funding support, deepen the corporate bond market

The RBI has allowed SCBs, AIFIs, NBFCs (in top, upper, and middle layers), and HFCs to provide partial credit enhancement (PCE) to bonds issued by corporates/special purpose vehicles (SPVs) for funding all types of projects. It has also provided bonds issued by Nondeposit-taking NBFCs with asset size of >Rs10bn. This should enhance the credit rating of the bonds issued so as to enable corporates to access funds from the bond market on better terms and thus deepen the corporate bond market. To limit the credit risk, RBI has restricted REs to offer PCE only in respect of bonds for which the pre-enhanced rating is ’BBB minus’ or better. The capital required to be maintained by REs providing contingent PCE for a given bond issue shall be based on the PCE amount and the applicable risk weight for the RE corresponding to the pre-enhanced rating of the bond.

Exhibit 1: RBI has cumulatively cut Repo rate by 50bps and changed its policy stance to Accommodative from neutral, raising hopes for more cuts

Exhibit 2: IIB, IDFCB, and RBL shall be relatively less impacted due to rate cuts owing to higher share of fixed rate book

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Sector Seasonality Report 08th December 2025 - Axis Securities