ACME solar reports strong performance for Q1 FY26

Key Highlights:

* Commissioned 350 MW projects including maiden 50 MW wind project in Gujarat, taking operational portfolio to 2,890 MW, ? 115.7% on YoY basis

* Won maiden standalone BESS[1]projects of 550 MWh contracted with NHPC

* Signed PPAs of 550 MW (FDRE 250 MW, Solar 300 MW) and 550 MWh of standalone BESS

* Generated CUF of 28.5% with 1,636 MUs, ?107.1% from Q1 FY25

* INR 1,072 Cr debt refinanced leading to ~95 bps interest cost reduction for the project

* Recently commissioned four SECI ISTS projects of 300 MW each rated CRISIL AA-/Stable

* 3.1+ GWh of BESS ordered from leading global energy system suppliers

Financial Highlights

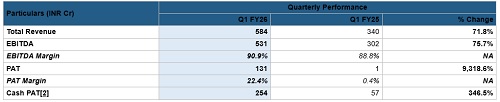

Key Consolidated Financial Highlights are as follows:

Consolidated Financial Highlights:

* Revenue increased by 71.8% for the quarter (y-o-y basis), driven by capacity addition and higher CUF

* Higher EBITDA margin of 90.9% in Q1 FY26 as compared to 88.8% in Q1 FY25 on account of higher scale and favorable operating leverage

* PAT margin stood at 22.4% in Q1 FY26

* Net debt to EBITDA of 4.2x as of Q1 FY26, well within the targeted range of 5.5x

* DSO (as billed) [4] of 36 days in Q1 FY26

Standalone Financial Highlights:

* Standalone financials account for in-house EPC business for the company’s own projects

* At Standalone level, the company reported total revenue of INR 364 Cr, EBITDA of INR 61 Cr resulting in EBITDA margin of 16.8%

* Capacity Commissioned:

* 350 MW projects commissioned during the quarter:

* 300 MW Acme Sikar (solar) contracted with SECI

* 50 MW Acme Pokhran (wind) - company’s first wind project, contracted with GUVNL

* Operational capacity stands at 2,890 MW, up 115.7% from Q1FY25

* The operational portfolio is expected to give a run-rateannual project EBITDA of INR 2,000-2,050 Cr, resulting in pre-tax ROCE of 14.5%[1]

* 100 MW Acme EcoCleanwind projectunder advanced stages of construction

Orderbook Addition:

* 550 MWh of standalone BESS projects contracted with NHPC won at a weighted average tariff of INR 2.20 lakhs/MW/month

* Total under construction portfolio stands at 4,080 MW plus 550 MWh of standalone BESS

PPA Signed:

* PPAs signed for250 MW FDRE, 300 MW Solar and 550 MWh standalone battery projects leading to over 55% of UCcapacity that is PPAsigned

* Grid connectivity and tariff adoption/orderreserved in place for entire 6,970 MW portfolio

ProjectsContracts Update:

* 3.1+ GWh of BESS ordered from leading global energy system suppliers including Zhejiang Narada and Trina Energy

* Commitments secured for key long leaditems like power conversion systems, transmission lines, power transformers and wind turbines

Financing and Credit Rating Updates:

* INR 1,072 Cr refinancing debttiedup at aninterest rate of~8.5% p.a. fixed for 5 years for 250 MW operational project in Rajasthanleading to:

* ~95 bps reduction ininterest cost for the project

* Standard Chartered Bank, Bank of AmericaandIndia InfradebtLimitedadded as new lenders to the debt portfolio

* Recently commissioned 4x300 MW SECI ISTS solar projects each received rating of CRISIL AA-/Stable

* Acme Aklera 250 MW (SECI offtake) upgraded to ICRA A+/Stable[7]

Operational Highlights

* 1,636 million units (MUs) generated in Q1 FY26 up 107.1% from Q1 FY25 driven by higher CUF and new capacity addition.

* Capacity utilization factor has increased from 27.0% in Q1 FY25 to 28.5% in Q1 FY26

* In Q1 FY26, Rajasthan-based operational assets with 2,250[8] MW contracted capacity delivered an average CUF of 30.3%

* Plant availability and grid availability at 99.4% and 98.7% respectively for Q1 FY26

Commenting on the quarterly performance, Mr. Manoj Kumar Upadhyay, Chairperson & MD, ACME Solar Holdings Ltd, said,

“We are proud to report another strong quarter, marked by robust financial performance and meaningful operational progress. The commissioning of 350 MW, including our first wind project, underscores our commitment to diversifying our clean energy portfolio. Securing our maiden standalone battery storage projects is a landmark moment - positioning us at the forefront of the energy transition as we scale solutions that enhance grid reliability and flexibility.

Our continued focus on execution excellence and disciplined financial management is clearly reflected in our margin expansion, significant improvement in cash PAT, and reduced debt cost. The adoption of tariffs for majority of our under-construction portfolio and signing of key PPAs reflect the strong demand for the renewable energy solutions. We remain confident in our long-term growth trajectory and are committed to delivering sustainable value to all stakeholders.”

Above views are of the author and not of the website kindly read disclaimer