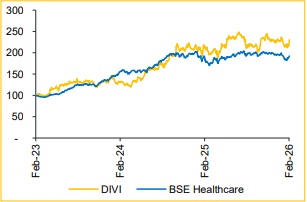

Accumulate Divi's Laboratories Ltd for Target Rs. 6,300 by Choice Institutional Equity

Growth Intact; Execution Remains Key to Value Creation DIVI remains positioned for continued high-teens growth, driven by the scaleup of commercial projects in custom synthesis and demand-led expansion in nutraceuticals. EBITDA is expected to see healthy expansion in FY26, supported by operating leverage at the Kakinada facility and an improving product mix. In peptides, the company remains focused exclusively on innovator contracts, with no foray into generics. We have marginally revised our estimate downwards by 0.4%/0.8% for FY26/27E and continue to value the stock at 45x the average of FY27–28E EPS, reflecting the view that the investment case is highly contingent upon timely execution and efficient ramp-up of commercial projects. This results in a revised TP of INR 6,300 (from INR 6,375), and we maintain our REDUCE rating.

Revenue and PAT Slightly Below Estimates Despite Margin Improvement

? Revenue grew 12.3% YoY / declined 4.1% QoQ to INR 26,040 Mn (vs. CIE estimate: INR 26,808 Mn).

? EBITDA grew 19.8% YoY / 0.2% QoQ to INR 8,900 Mn; margin expanded 214 bps YoY / 147 bps QoQ to 34.2% (vs. CIE estimate: 33.1%).

? PAT declined 1.0% YoY / 15.4% QoQ to INR 5,830 Mn (vs. CIE estimate: INR 6,691 Mn); margin stood at 22.4%.

? The company recognised an exceptional charge of INR 740 Mn related to new Labour Codes; adjusted PAT stood at INR 6,570 Mn.

Custom Synthesis (CS) to Sustain 20%+ Growth on Commercial Scale-up

The CS segment continues to deliver strong growth momentum, which we expect to sustain, with the segment likely to remain a key growth driver for the company. A major catalyst will be three dedicated commercial projects, under validation at present, with commercial ramp-up expected from H2FY27. These projects relate to innovator products, with the required capex already committed, enhancing execution visibility. In addition, the company is expanding its presence in peptide programs on the innovator side, where validation is under way. We expect the CS segment to deliver 20%+ growth in the medium term, supported by a strengthening commercial pipeline and scaling up of validated projects.

Higher-value APIs and Nutraceuticals Drive Stability

While the generics segment has seen moderation in the past few quarters, primarily due to pricing pressure, we expect volume growth to offset pricing headwinds, going forward. The company is also shifting its portfolio towards higher-value APIs, which should support more stable and sustainable growth. The nutraceuticals segment, meanwhile, continues to deliver healthy growth, driven by structurally improving demand in regulated markets. Given its limited exposure to pricing volatility, we expect the growth momentum to sustain, further supported by the company’s backward integration capabilities.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131