Year Ender Currency Outlook 2021 By Mr. Gaurang Somaiya, Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is the Year Ender Currency Outlook 2021 By Mr. Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services

“Rupee in 2021 consolidated in a broad range of 72.50 and 75, but just before the year-end, it surpassed the barrier and hit a high of 76.50. Suspected RBI intervention kept the volatility in control and led to stabilising the currency. The central bank has played a major role in curtailing the volatility of the rupee and, at the same time has built a good quantum of FX reserves to deal with future uncertainty if there is any. Most central banks across the globe are now moving towards policy normalization and market participants have already started to factor in this aspect. In this month, The Fed already announced to increase its pace of bond tapering and the Bank of England announced to increase to raise interest rates by 15bps and with the ECB now seems to be getting led dovish in its commentary suggests that volatility could remain elevated in the near future.

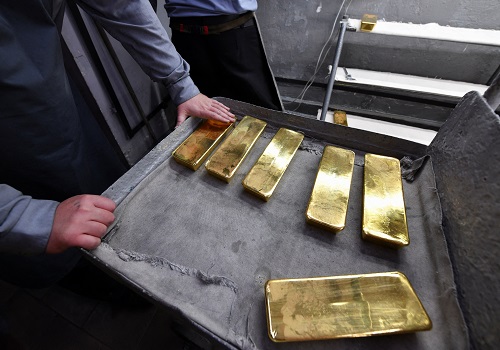

Rising inflation has been one of the major factors for the central banks to move towards policy normalization and we expect that in the year 2022, this could continue to be one of the influencing factors for the central banks to decide their further course of policy action. Higher commodity prices following supply-related concerns and stronger dollar index led to an uptick in inflation. From Agro to metals to soft commodities everything moved up in 2021. Supply constraints of these commodities were led by COVID restriction that most countries levied and how and when these restrictions will be lifted is nobody’s call as of now. The rise in cases led by the new variant has dampened the overall market sentiment where most of the riskier currencies have cooled from the recent highs.

On the domestic front, recent weakness in the rupee was seen after the FIIs started to pull out of funds from the India equities and also as trade deficit widened to record high levels following rise in crude oil, coal and gold imports. On the other hand, losses have been restricted also after CEA exuded confidence that India would achieve double-digit growth in the current financial year on the back of policy initiatives and continuing reforms. The government expects that overall growth will be supported by supply-side push from reforms and easing of regulations, infrastructural investments, boost to manufacturing sector through the PLI schemes, recovery of pent-up demand, increase in discretionary consumption subsequent to rollout of vaccines and pick up in credit.

In the coming year, investors will be backing up on better domestic fundamentals that would support the rupee, but at the same time policy normalization could extend gains for the dollar. The recent move in the dollar suggest that the range has shifted higher and further lows in case of the rupee could be bought in and all the above factors mentioned will be important to determine trend for the rupee. We expect the USDINR pair to trade with a positive bias and with the range of 73.50 and 77.50.”

Above views are of the author and not of the website kindly read disclaimer

Top News

Markets to trade with positive bias

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">