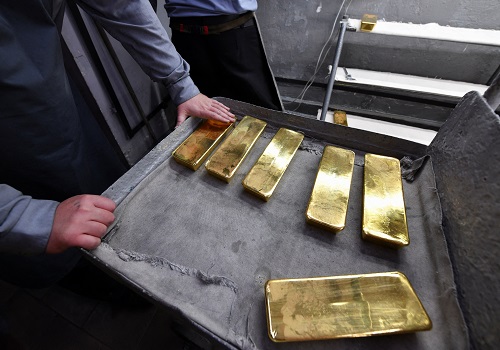

Gold bound for third straight weekly gain on Fed pause views

Gold prices were set on Friday for a third consecutive weekly gain, underpinned by hopes that the U.S. Federal Reserve will pause interest rate hikes after its July meeting.

Spot gold was little changed at $1,970.20 per ounce by 0409 GMT, but has gained 0.8% so far this week. On Thursday, the metal slipped from a two-month high as the dollar and bond yields climbed on stronger-than-expected U.S. labour market data. [USD/][US/]

U.S. gold futures gained 0.1% to $1,972.30.

Gold prices have been supported by expectation that the Fed would increase rates for the last time next week in its current tightening cycle. Most economists polled by Reuters expect a 25-basis point hike at the July 25-26 Fed meeting.

Lower interest rates reduce the opportunity cost of holding zero-yielding bullion.

"Real rates are disincentive to invest in gold and in the short- to medium-term, cap the upside potential for investors without a major risk event occurring," said Michael Langford, chief investment officer at Scorpion Minerals.

"Without a major risk eventuality, gold appears to be trading with froth."

The dollar index slipped 0.1%, but was headed for a weekly rise, while benchmark U.S. Treasury yields were higher. [USD/][US/]

China's foreign exchange regulator said it would keep the yuan stable at balanced levels in a forceful manner and prevent sharp volatilities in the yuan exchange rate. [CNY/]

Next week, market participants will also focus on a Bank of Japan meeting amid speculation of imminent policy tweaks, while the European Central Bank is expected to raise interest rates by 25 basis points, according to economists in a Reuters poll.

Among other metals, spot silver rose 0.2% to $24.82 per ounce, platinum was up 0.3% at $956.50, and palladium gained 0.3% to $1,282.09