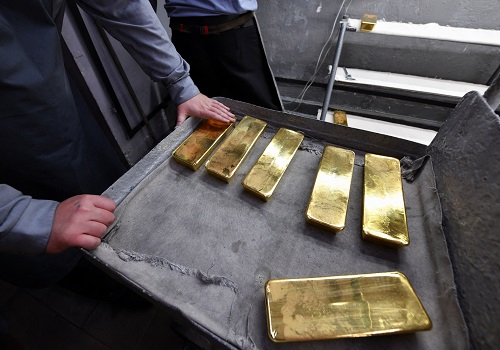

Gold prices climb towards 1-month peak on Fed pause bets

Gold prices climbed on Monday towards a one-month peak scaled in the previous session, supported by a slight pullback in the dollar and prospects that the U.S. Federal Reserve would take a pause from interest rate hikes this year.

Spot gold gained 0.3% to $1,945.40 per ounce by 0334 GMT, after climbing to as high as $1,952.79 on Friday. U.S. gold futures added 0.2% to $1,971.70.

"Gold is hovering under resistance at the $1,951 level in thin trading conditions given the U.S. holiday," said KCM Trade Chief Market Analyst Tim Waterer. [USD/]

"The precious metal will likely be depending upon Treasury yields taking a step lower in order to make a push to $1,950 and beyond this week." [US/]

As gold yields no interest of its own, it tends to lose its attraction when interest rates rise.

Data on Friday showed U.S. job growth picked up in August, but the unemployment rate jumped to 3.8% and wage gains moderated, strengthening the case of an interest rate pause this month.

According to the CME FedWatch tool, traders now see a 93% chance of the Fed leaving rates unchanged at its September meeting.

The full impact of the U.S. Fed's interest rate hikes that began in March 2022 has still not been completely transmitted to the real economy, a former vice chairman of the central bank said.

SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings rose 0.10% on Friday. [GOL/ETF]

Elsewhere, spot silver added 0.4% at $24.27 per ounce, platinum was up 0.1% at $961.51 and palladium rose 0.5% to $1,224.28