Weekly market update on 31 may 2021 by Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion

Bullion prices ended with gains after data showed the increase in consumer prices in the month of April was not as severe as to raise concerns about any policy tightening by the central bank. An inflation reading preferred by the Federal Reserve showed an acceleration in the pace of price growth but not as much as traders had feared.

While the increase in prices exceeded economist estimates, the jump was apparently not as severe as to raise concerns about the Federal Reserve tightening monetary policy. The Fed has attributed the recent increase in prices to "transitory factors" and has repeatedly hinted that it will not consider tightening until prices exceed 2% for "some time."

Physical gold demand in second-biggest bullion consumer India was negligible with most jewellery stores still shut by COVID-19 lockdowns, forcing dealers to offer steep discounts. Dealers offered discounts of up to $10 an ounce, the highest since mid-September 2020, over official domestic prices, unchanged from last week. A few states are considering easing restrictions from June 1 and that could help attract retail consumers.

China's net gold imports via Hong Kong jumped 219% in April from the previous month, Hong Kong Census and Statistics Department data showed. Net imports stood at 52.821 tonnes in April, compared with 16.545 tonnes in March, the data showed. Total gold imports via Hong Kong rose to 55.699 tonnes from 21.766.

Swiss exports of gold to mainland China surged in April to their highest since December 2019, customs data showed, as demand for gold in the world's biggest bullion consuming nation rebounded from a slump during the coronavirus pandemic. Switzerland is the world's largest gold refining centre and transit hub. Its numbers provide an insight into global market trends. Swiss customs data show exports of 40.2 tonnes of gold worth around $2.5 billion at current prices to China in April – more metal than was sent in the last 14 months combined.

Energy

Crude oil gained amid hopes that an ongoing economic recovery in the United States will have a positive impact on oil demand. OPEC and its allies, collectively known as OPEC+, will meet on June 1 to consider the current oil market situation and decide on production levels. It is widely expected that the members will agree on a production hike as earlier proposed.

U.S. crude oil output jumped 14.3% to 11.2 million barrels per day (bpd) in March from 9.8 million bpd in February, the U.S. Energy Information Administration (EIA) said in its monthly 914 production report. Output sank 1.3 million bpd in February when extreme weather froze natural gas and oil wells and cut power supplies to million of customers in Texas and other South Central U.S. states. That 1.4 million bpd increase in March was the biggest monthly gain on record, according to EIA data going back to 2005.

Global oil deficit is currently seen at around 1 million barrels per day, Russia's deputy prime minister Alexander Novak told reporters. He added that the Organization of Petroleum Exporting Countries and its allies, a group known as OPEC+, should take into account possible increase in oil production by Iran when considering its further steps.

Natural gas rose buoyed by forecasts for warmer weather in two weeks and a projected increase in liquefied natural gas (LNG) exports. Higher temperatures in two weeks were expected to boost demand for fuel to power generators and keep air conditioners humming.

Recent data from Energy Information Administration (EIA) that showed a larger than expected drop in crude inventories in the week ended May 21st. Data released by Baker Hughes showed U.S. rigs drilling for oil increased by 3 to 359 this week, rising for a fourth consecutive week. The total active U.S. rig count, including those drilling for natural gas, climbed by 2 to 457.

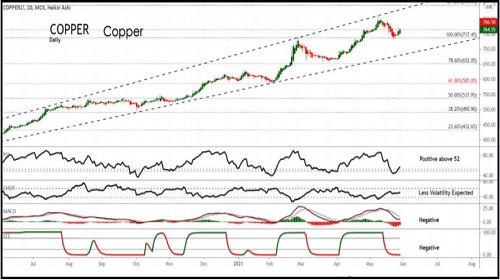

Base Metals

Copper prices advanced, buoyed by demand optimism on reports of U.S. President Joe Biden's plans to make a $6 trillion budget announcement, while supply concerns in top producer Chile also supported sentiment. Biden will also seek to raise the U.S. federal spending to $8.2 trillion by 2031, which will likely boost growth and infrastructure.

A strike by workers at BHP's Escondida and Spence copper mines in Chile entered its second day, as the company uses replacement workers to ensure continued production. The company is placing substitute workers in the mines located in northern Chile, a move that the union opposes. The strike at Escondida, the world's largest copper mine, and at the smaller Spence comes as copper prices have spiked amid soaring demand as the world's largest economies revive following more than a year of coronavirus-induced stagnation.

Zinc treatment charges (TCs) in China jumped to their highest level in more than five months as power shortages in the Yunnan province left smelters facing production cuts, weakening demand for raw material zinc concentrate. Spot TCs, paid by miners to smelters to process imported concentrate into refined zinc in top consumer China, were last assessed by Asian Metal at $95 a tonne, up 35.7% from the previous day and the highest since Dec. 4.

China's industrial profits logged a sharp increase in January to April period, data released by the National Bureau of Statistics revealed. Industrial profits increased by 106 percent in January to April period from the same period last year. In April, industrial profits were up 57 percent annually. However, this was much slower than the 92.3 percent expansion seen in March. This slowdown was largely caused by rising commodity prices

A report released by the National Association of Realtors showed pending home sales in the U.S. unexpectedly tumbled to their lowest level in nearly a year in the month of April. NAR said its pending home sales index plunged by 4.4 percent to 106.2 in April after surging up by 1.7 percent to a downwardly revised 111.1 in March. The steep drop surprised economists, who had expected pending home sales to increase by 0.8 percent compared to the 1.9 percent jump originally reported for the previous month.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">