We had a roller coaster move at the start of the Week - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (50395) / Nifty (14930)

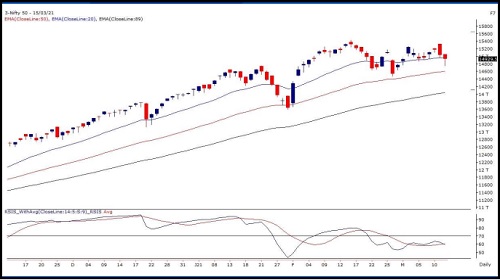

Post the sharp sell off on Friday, our markets started the day on a flat note above the 15000 mark. However, we saw selling pressure right from the word go and Nifty corrected sharply to breach 14750 level during the day. The banking index was reeling under pressure and it seemed that bears had complete control. However, the index started recovering gradually in the last couple of hours and managed to trim much of the intraday losses and end well above 14900.

We had a roller coaster move at the start of the week as the index corrected for most part of the day and then it recovered in last couple of hours to recoup most of the intraday losses. Nifty registered its all-time high a month ago and since then our market is going through a corrective phase. Trading in this corrective phase has been difficult as the market has witnessed volatile moves on both the sides of the trade. As of now, there are no signs to the end of this corrective phase and hence, we could continue to see such volatility in the near term.

Nifty Daily Chart

Nifty Bank Outlook - (35183)

The BANKNIFTY started the week on a flat note but within few minutes of trade, selling reinforced in the market (especially in financial names), which led to a sharp correction in the first hour. The weakness extended in the following hours to fall as much as 1000 points from the morning high. However the sentiments seemed to have improved quite a lot in the latter half of the session. Eventually, due to smart recovery in some of the heavyweight constituents, the banking index managed to trim major portion of losses to conclude with less than a percent loss.

Around the mid-session, the overall picture looked a bit dicey as prices were trading convincingly below the recent swing low of 34658.70. With the help of the late recovery, we can see relatively better close on the daily chart. However, we are still not completely out of the woods; because the price structure on the intraday chart does not bode well for the bulls. We can see BANKNIFTY trading below ‘200-SMA’ on the hourly time frame and till the time banking index does not cross 35500 – 36000, the up move should only be construed as a bounce back. Hence, we need to see if there is any follow up buying to the yesterday’s last hour surge, which probably would decide the direction for the remaining part of the week.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Opening Bell : Markets likely to get optimistic start tracking positive cues from global peers