Opening Bell : Markets likely to get optimistic start tracking positive cues from global peers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

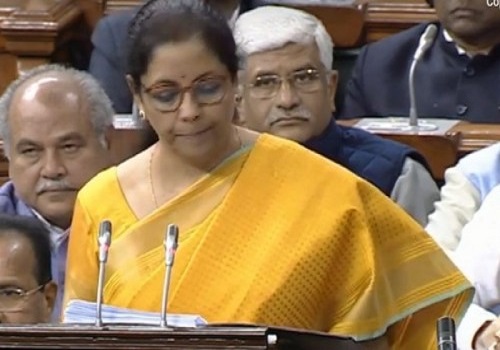

Indian markets ended lower on Monday following a sell-off in IT and oil shares amid unabated foreign fund outflows and weak leads from the US markets. Today, markets are likely to get optimistic start tracking positive cues from global peers. Traders will be taking encouragement as Central Board of Direct Taxes (CBDT) Chairman Ravi Agarwal said the government is confident of not only meeting the direct tax collection target for FY24, but also exceeding it. Some support will come as the National Sample Survey Office (NSSO) said the unemployment rate for people aged 15 years and above in urban areas dipped to 6.4 per cent in the July-September quarter. Joblessness, or unemployment rate, is defined as the percentage of unemployed people in the labour force. The unemployment rate in the September quarter of FY24 was 6.6 per cent. Traders may take note of a report by CRISIL stating that the tariff hikes proposed by Donald Trump may pose threat to India’s exports but the country’s surplus in services trade and robust remittances flow may provide comfort. However, foreign fund outflows may drag market down. Foreign institutional investors (FIIs) extended their selling for the 11th straight session in this month as they sold equities of more than Rs 1,400 crore worth on November 18. There may be some cautiousness as Union Finance Minister Nirmala Sitharaman said people are finding current interest rates very stressful and urged banks to make them affordable. The finance minister said that at present, India requires industry to ramp up and invest in new facilities, and added that lowering lending rates can help achieve the Viksit Bharat aspiration. There will be some buzz in airline stocks as domestic air passenger traffic crossed 500,000 for the first time in a single day on November 17, reflecting strong travel demand amid festive and wedding seasons. IT stocks will be in focus with a private report that the IT sector is expected to witness subdued growth in the third quarter of FY25, primarily due to seasonal factors. However, the report noted that a recovery is likely in the fourth quarter as companies begin to ramp up execution of recently signed deals. There will be some reaction in power stocks with a private report that the Centre will launch a production-linked incentive (PLI) scheme by the end of the current financial year to promote the manufacturing of transmission equipment. Investors will focus on the NTPC Green IPO and the remaining Q2 earnings as the second quarter of FY25 results season nears its conclusion.

The US markets ended mostly higher on Monday as investors anticipate quarterly earnings from AI leader Nvidia and Tesla jumped on the prospect of favorable policy changes from the incoming Trump administration. Asian markets are trading mostly in green on Tuesday tracking Wall Street gains, even as investors parsed discussions from Chinese financial policymakers’ at an investment summit in Hong Kong.

Back home, Indian equity benchmarks ended Monday's trading session in negative territory, weighed down by weak global cues. Markets made a slightly positive start but soon slipped into red terrain as traders turned cautious with Reserve Bank Governor Shaktikanta Das’ statement that the central bank has ensured a soft landing after having faced with various headwinds, but risks of inflation coming back and growth slowing down do remain. Some concern also came as India’s foreign exchange reserves declined for the sixth straight week, mainly due to the Reserve Bank of India’s intervention in the foreign exchange market as the rupee came under pressure from sustained foreign investment outflows. However, markets managed to erase most of their losses in early afternoon deals, taking support from Central Board of Direct Taxes (CBDT) chairman Ravi Agarwal’s statement that the government will exceed the Rs 22.07 lakh crore direct tax collection target set for the current fiscal. Some support also came amid a private report stating that India has emerged as the third most-improving geography in terms of business environment. But, markets failed to hold recovery and added more losses in late afternoon session owing to relentless foreign fund outflows. According to exchange data, Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,849.87 crore on Thursday. Foreign investors have pulled out Rs 22,420 crore from the Indian equity market so far this month, owing to high domestic stock valuations, increasing allocations to China, and the rising US dollar as well as Treasury yields. Some anxiety also came amid reports that overseas investors are cutting their holdings of Indian bonds at the fastest pace since at least June, as rising US yields damp the appeal of the Asian nation’s fixed-income securities. Finally, the BSE Sensex fell 241.30 points or 0.31% to 77,339.01, and the CNX Nifty was down by 78.90 points or 0.34% to 23,453.80.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on?Market Wrap by Shrikant Chouhan, Head Equity Research, Kotak Securities

More News

The index started the session on a positive note - ICICI Direct

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">