We had a positive start to the last week of the January month - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (46286) / Nifty (13635)

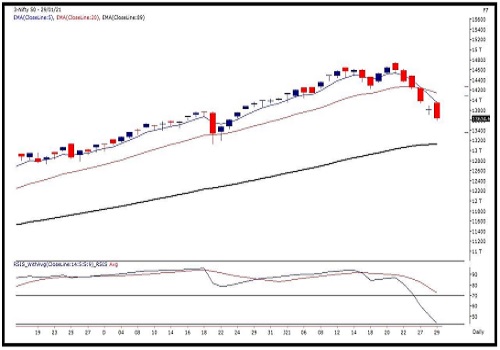

During the last week, we had a positive start to the last week of the January month. However, it turned out to be a formality as markets skidded in the initial hours not only to pare down gains but also to enter a negative territory. Unlike recent trend, the corrective move got extended beyond two trading sessions. In fact, as the week progressed, things worsened to breach all intermediate key supports one after another. Eventually, the Nifty ended the week tad above the 13600 mark with a massive cut over five percent on a weekly basis.

It was certainly a biggest weekly drop after September 2020 despite being a truncated week. Before anyone could realize, Nifty wiped off more than 1100 points in merely six trading sessions. Although it was intimidating, we were not surprised of this sudden fall; because market had hinted towards it and we continuously highlighted those caveats.

Markets were deeply overbought since many weeks, but the real indication came when we witnessed a ‘3-points Negative divergence’ in the RSI-Smoothened oscillator on daily chart in all key indices (NIFTY, BANKNIFTY and NIFTY MIDCAP 50) after clocking their fresh record highs. Adding to this, BANKNIFTY confirmed a ‘Double Top’ pattern on previous Friday after breaking its crucial swing low. Now, we are considerably off record highs and the way charts are shaped up, it does not bode well for the short term bulls

Now, looking at the weekly time frame close below ‘5-EMA’ along with ‘Shooting Star’ pattern on Monthly chart, the Nifty is possibly headed towards strong support zone of Weekly ‘20-EMA’ and daily ’89-EMA’ zone of 13200 – 13000. However, since the Finance Minister is going to present the ‘Union Budget’ today, the immediate direction would be decided on the actual outcome of the event. But looking at the price structure, we do not expect Nifty to surpass 14000 – 14200 before completing its corrective phase.

So if market reacts positively post the event, 13800 – 14000 – 14200 becomes a cluster of resistances and a move towards this should ideally be used to lighten up longs. On the other hand, sooner or later, the Nifty is likely to extend correction towards mentioned levels of 13200 – 13000. Although we have been cautious of late, we believe that a fall towards these supports should be used to accumulate quality propositions in a staggered manner with a broader perspective.

Nifty Daily Chart

Nifty Bank Outlook - (30565)

Following the positive momentum of the last hour of expiry day, the bank nifty started with a gap up opening. Subsequently, the bank index traded in a range for the major part however in the last hour similar to the expiry session we witnessed a strong upmove to mark days high.

Eventually, it seemed that the bank index is going to end with strong gains but a sudden sell-off in the broader markets erased some gains to finally end with gains of 0.68% at 30565. During the previous week, we mentioned a double top bearish breakdown which resulted in a sharp selloff of more than 3000 points from an all-time high to the intra-week low of 29687.

With high oversold conditions on hourly charts, the bank index has managed to bounce back from the lower levels, and the way broader markets have tumbled it's quite surprising the way the bank index has performed in the last two days. However, we sense that we are still not completely out of the woods and expect selling to reemerge at higher levels.

Today as the budget will be announced we are likely to see a spike in volatility hence traders are advised to avoid aggressive bets . As far as levels are concerned, 30000 - 29600 is the immediate support whereas 31200 - 31700 is the resistance.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One