The weekly expiry session turned out to be a day of consolidation - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (51532) / Nifty (15173)

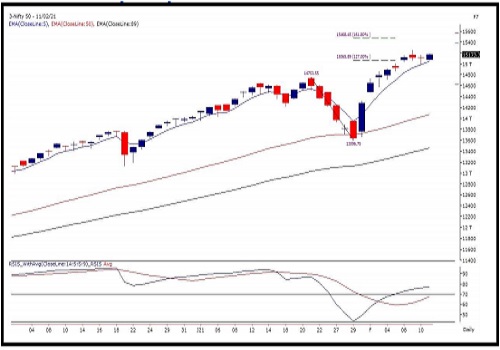

The weekly expiry session turned out to be a day of consolidation as the Nifty traded with a narrow range and ended the day with gains of less than half a percent. Unlike last week, it has been a week of consolidation so far for the indices as Nifty as well as Bank Nifty have traded with a narrow range.

There are no signs of reversal of the trend and hence, this just seem to be a time-wise correction which was much required post the sharp run up in the budget week. As of now, there are no signs of any deeper retracements and hence, once this consolidation is over we expect the markets to resume its uptrend.

The immediate supports for Nifty are placed around 15100 followed by 14975 whereas resistance is seen around the swing high of 15250 above which Nifty should resume momentum. Although the indices have not moved much during this week, the stock specific action has been buzzing and has provided opportunities for trading. Till the index is locked in this range, traders are advised to look for potential stock specific movers and trade with proper risk management.

Nifty Daily Chart

Nifty Bank Outlook - (35752)

We had a flat opening yesterday despite SGX Nifty indicating a sluggish start. In the initial hour, BANKNIFTY marched towards 36000 but the attempt got sold into. The similar attempt was made at the midsession as well and the result was the same as the previous one.

During the remaining part of the session, banking index consolidated in a range to conclude the weekly expiry on a flat note. Yesterday, every valiant attempt to go beyond 36000 was failing comfortably and at the same time, it was not weak enough to sneak below 35500 as well. So at the end, it turned out to be a boring weekly expiry and it’s clearly visible looking at the price action in last 3 – 4 sessions. The undertone remains bullish but do not have enough strength to extend the recent rally.

Hence, the commentary may sound a bit repetitive as there was no major action in the index. For the coming session, 36000 – 36200 remains to be an immediate resistance; whereas on the lower side, 35500 is the level to watch out for. A move below this key level would result into some weakness in the banking space.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One