The rupee is expected to appreciate today amid retreat in dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

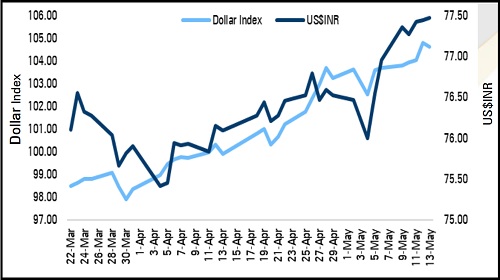

• The US dollar retreated from its high amid rise in risk appetite in global markets and disappointing economic data from the US. Data showed consumer sentiment for early May deteriorated to its lowest level since August 2011 as concerns about inflation persisted. However, sharp downside was cushioned on surge in US treasury yields and concern over slowing global economic growth

• Rupee future maturing on May 27 depreciated marginally by 0.01% amid strong dollar and rise in crude oil prices. Further, the rupee slipped on weak domestic market sentiments

• The rupee is expected to appreciate today amid retreat in dollar and rise in risk appetite in the global markets. However, sharp gains may be prevented on consistent FII outflows and elevated crude oil prices. Additionally, investors fears that due to soaring inflation central banks across globe are dialling back easy money and challenging the already weary economic growth. US$INR (May) is expected to trade in a range of 77.35-77.80

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">