The expectation of a Fed rate hike would keep the metal prices under pressure - Mr. Saish Sandeep Sawant Dessai, Angel One

Below is Basemetal Article by Mr. Saish Sandeep Sawant Dessai, Research Associate- Base Metals, Angel One Ltd

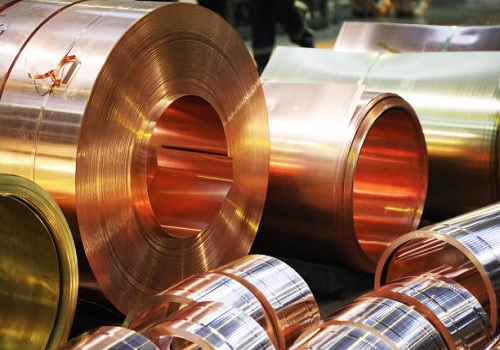

The industrial metals continue to move southwards, as prices of all the metals end on a lower note, as LME Nickel was the top losing metal off the lot.

Individual metals, including copper, fell to 20-month lows while aluminum fell to one-year lows as a result of fresh Covid-19 restrictions in China coupled with fears of high-interest rates given the rising inflation in the US.

Meanwhile, concerns about an economic slowdown have dampened demand for industrial metals. The U.S. Federal Reserve is expected to raise rates in its upcoming meeting this month. These higher rates have increased fears of recession, which are now anticipated globally and in the US.

As the dollar is hovering near 20-year highs, which makes the metals priced in the dollar costlier for buyers holding other currencies, it can also reduce the demand for the metals.

However, the downside looks limited given encouraging developments from the world's largest consumer of metals, China. As lockdowns were eased, the nation's exports rose at the fastest rate in five months. Additionally, imports of copper increased by 15.5 percent in June compared to the previous month.

Outlook: While the improvement in the Chinese economy would limit the fall in metals, the expectation of a Fed rate hike would keep the metal prices under pressure.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Tariff Tensions Rise: How the US Move on Russian Oil Could Impact India by Mr. Amit...